Ask Three Questions to Ensure Your 2019 Go-to-Market Strategy is a Success

It’s almost Fall – back from the beach, leaves are changing, and starting in October, it’s 2019 strategic planning season.

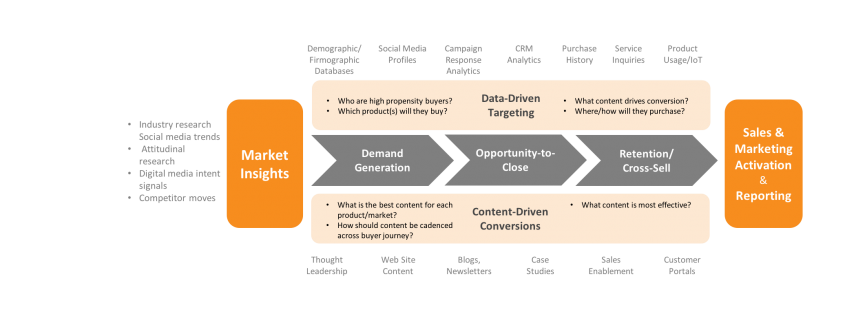

As we have written in previous blogs, the discipline of go-to-market strategy development and execution is changing rapidly. The traditional exercises of branding, messaging, new product launch, channel strategies, and setting financial targets remain. But the fuel to drive successful GTM execution in 2019 and beyond is rapidly shifting to (1) better data and (2) more effective content. Traditional competitors and new market entrants are gaining or losing share based on how well they leverage rapidly growing customer data sources and digital content.

The above graphic provides a simplified roadmap to help Sales & Marketing teams frame how data and content sources can be used across the customer lifecycle.

We see three critical questions executives need to ask their organizations to improve the odds of meeting 2019 targets—and outflanking competitors.

1. Are we leveraging readily available customer data signals to help Sales & Marketing target the best prospects with the right offers?

The richness and volume of customer data available to most companies continues to surprise even the most seasoned executives. There is a lot of justified market hype around artificial intelligence – essentially algorithms that predict who, what, and when customers are ready-to-buy. Without getting into details, here are a few examples:

- New Prospect Intent-to-Buy Signals: The are many readily available data sources from BOTH external 3rd parties and internal sources that signal when prospects are entering a purchase cycle. These include media content consumption data, web-site activity, social media (e.g. LinkedIn), press releases, etc. These are incredibly powerful signals that can narrow and focus both Marketing and Sales activities to target on the best prospects each quarter. Beyond just lead scoring – everyone can do that – these signals can enable tighter segmentation and message targeting.

- Existing Account/Buyer Ready-to-Buy Signals: Three data sources from existing customers are providing companies with incredibly powerful growth opportunities as well as manage churn and cross-sell. As more products have cloud-based features, these data sources include:

- Product Usage Data: As more products have cloud-based features, IoT capabilities, and shared by multiple users, product usage patterns provide powerful signals. Leading financial service players such as PayPal and technology providers such as Hewlett-Packard are capitalizing on product usage patterns to drive revenues.

- Customer Support Inquiries: Most companies experience 1000s of customer support inquiries each week – some positive and others potentially negative. We are seeing companies such as Dell, Microsoft, and CapitalOne turn high volumes of inbound support requests into short-sales cycle growth opportunities.

- Customer Purchase Patterns: Direct marketers have been using RFM (recency, frequency, monetization) models for years. But even with customer data privacy being increasingly critical, you don’t need to identify specific customer behaviors. Rather purchase patterns exhibited within specific buyer personas, customer segments, or product types can identify both revenue opportunity and risk.

We could add many more data sources to this list, but the real opportunity is for senior executives to challenge their teams to identify and explore the many different existing data sources that can be used to significantly improve Sales & Marketing channels to target the right buyers, with the right products and messaging, at the right time.

2. Are we identifying the most effective content marketing collateral and tools to improve conversion rates?

Too many marketing executives are focused on creating new content for every campaign, every quarter. Yes, creating and promoting compelling content is critical to converting prospects to buyers.

But ask yourself a simple question: how much content has been created that just “sits on the shelf” and does not get consumed by either prospects or sales channels? Content is expensive to produce and maintain…focusing on the right content is increasingly critical. As the above graphic depicts, different types of content are needed at different stages of the customer buying process. As you plan your 2019 GTM strategy, consider doing the following:

- Content Inventory: Companies first need to analyze their existing content inventory.

- What content already exists? This would include both internal content and 3rd party content produced by analysts and channel partners.

- Where is it located? Most companies have content scattered in many different locations – the web site, sales and marketing portals, cloud storage apps, and even personal computer hard drives. If you can’t find the content, you can’t use it or measure its effectiveness.

- How effective has it been? We can quickly determine which content gets the most usage…at least that acts a proxy for effectiveness.

- Content Map & Gap Analysis: The critical question is what is the best content to drive conversion at a) each stage of the buying cycle, and b) for specific products and market segments. Creating a “content map” can be very powerful and quickly done by tagging content based on its applicability to market segment, buyer persona and buying stage. It will show where content exists and where it doesn’t.

- Content Performance Analytics: Lastly, there are many tools that can be used to quickly answer two questions:

- What content is most effective? Whether it’s looking at response rates, usage rates, A/B testing, etc. there are many ways to identify which pieces of content and what messaging are the top 20% most effective. But if you can’t answer this simple question, you are pouring money and time down the drain.

- Where do we have clear content gaps? Winning go-to-market strategies focus on filling content gaps rather than just creating all new content for every campaign. When content works, keep re-using it! When there is no content, go build it.

Content marketing is rightly gaining significant importance as buyers’ response to emailing drops, telesales calls go unanswered, and their expectation for personalization increases. Companies who focus on identifying, tracking and focusing on the best performing content are seeing 50-200% improvements in conversion rates.

3. How can better data signals and content (e.g. predictive analytics) actually “activate” customer buying activity and drive effective Marketing/Sales plays?

This is the last and most important question to answer. Without exception the biggest issue we see executives highlighting is:

“No matter how much data and content analytics we do, it’s a challenge getting our front-line Marketing and Sales teams to use analytic insights to make better decisions”

—Chief Revenue Officer

We call this “activation”: Translating analytic insight into action. Without getting into deeper technology and human behavior discussions (we will save that for future blogs), there are two “activation barriers” that must be systematically addressed:

- The Technology Activation Barrier: Every Marketing and Sales professional has 2-3 core “workflows” (e.g. software tools) they use every day. If your customer data and content analytics can’t be easily inserted into those software platforms and work processes, they will have no business impact. But, “activating analytics” is easily doable if data scientists and content marketers focus on how analytic insight can get delivered through these software delivery tools:

- CRM: All of the above analytics (opportunity scoring, segmentation, next logical product, best content, preferred buyer channels, etc.) can be readily delivered into Salesforce, MS Dynamics, or other CRM platforms – it just requires focus and some work.

- Marketing Automation: Ditto….it just requires determining the key 3-5 predictive analytics data fields and then knowing how to deploy them into tools like Eloqua, Marketo, Pardot or whatever marketing automation platform is needed.

- Web Content and E-Commerce: Once again, GTM analytics teams need to work with experts in platforms such as Adobe, Drupal, others to make sure the data and insights can be acted upon

- The Human Behavior Activation Barrier: Ok, so we still have businesses and customer engagement run by human beings. Sales reps are notorious for largely ignoring “lead scoring”, “buyer personas”, and “content recommendations”. Many reps believe that either high volume activity or their own gut instincts will suffice—and the top 20% of sales performers may actually not need much customer and content analytics. But we all know that 2019 business targets will not be achieved unless the bottom 80% of your Sales & Marketing resources also perform.

In future blogs, we will go into greater detail on how to overcome these technology and human “analytics activation” barriers.