AEP Digital Listening Bulletin #3

AEP Comes to a Close, Providers Double Down on Targeting Specific Audiences…But Has Consumer Fatigue Set in?

Welcome to the third and final installment of our Fall 2019 AEP Digital Listening Bulletin. In this periodic e-mail, we take a look at the trends, conversations, and themes that we are seeing dominate the Annual Enrollment Period discussion in the final weeks as carriers, brokers, agents and enrollees close out this annual process.

With only one day to go before AEP closes, consumer fatigue with MA advertising appears to have set in. Despite significant advertising and marketing investment, KFF just released a study that shows how few people actually voluntarily switch plans during AEP. Consumers get smarter about Supplemental Plans—and carriers get smarter about targeting. And the issue of social isolation among seniors garners a lot of attention.

Here we go.

“Don’t Delay, One Day Remains…Call Now”

With over 500 million DM pieces distributed and more than 300,000 TV spots being run this AEP season, it’s not surprising that consumer patience may finally be wearing a bit thin:

- “This the the (sic) time of year when Humans (sic) Medicare Advantage Plan commercials ruin television. I can’t imagine the amount of your premium payments they spend on relentless advertising.”-@bchrisphotos

- “On a side note: the commercials from the companies providing these plans, at this time of year, are about as annoying as political ads.”-@GreyEyes7

- One consumer even suggested that a significant—but unmentioned—benefit of M4A would be “NO MORE MEDICARE ADVANTAGE COMMERCIALS FOR 2 LONG MONTHS!! Oy, they’re driving me crazy.”– @TinaMcGugan

While it remains to be seen if these investments will lead to the 24.4 million enrollees as projected this year, it seems that all of this messaging may not be doing much to change the behaviors of current enrollees.

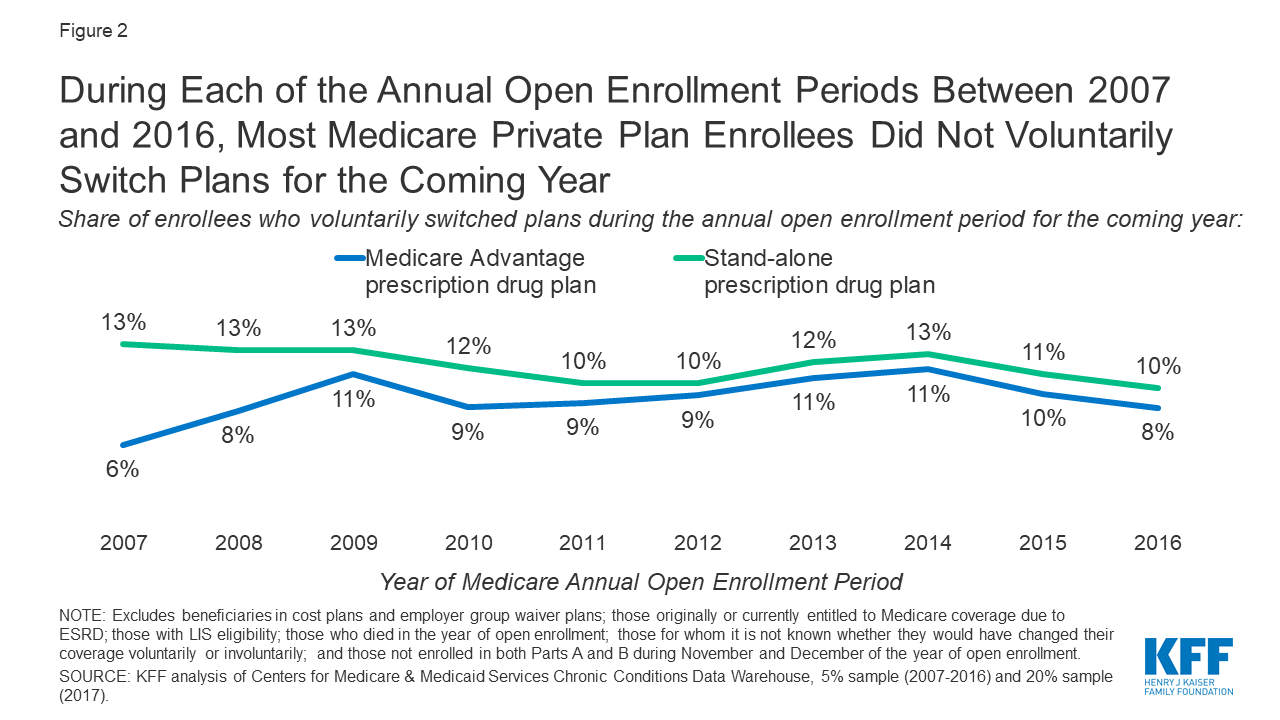

KFF just released a study which found that only a small share of MA-PD and PDP enrollees without low-income subsidies (8% and 10%, respectively) voluntarily switched to another plan during the 2016 annual open enrollment period for the 2017 plan year (the last year for which the analysis was available.)

There’s a lot of debate as to why this is the case.

One school of thought (the “emotional” one) suggests that consumers are happy with their current plan. CMS reportsthat 81% of Medicare Advantage Prescription Drug (MA-PD) members are enrolled in a plan rated at least 4 stars overall, up from about 75% last year, which lends credence to that theory.

Another school of thought (the “rational” one) suggests that the process of comparing plans is too challenging for many consumers.

- “Have always used Medicare, United Healthcare supplement, and Humana Wal Mart Part D Rx. Thinking about looking at an Advantage Plan but hate the thought of all the research changing programs will take. I have enough trouble with just the Part D plans.”-wagonmaster2

A November KFF analysis found that millions of current enrollees in stand-alone Medicare Part D prescription drug plans will face premium and other cost increases next year unless they switch to lower-cost plans this year.

With an average of 28 Medicare Advantage plans and 28 stand-alone Part D plans available to beneficiaries in 2020, plan comparison will be a challenge for many this year.

The answer, of course, is that it is both. We expect that marketers and their executives will be evaluating their significant advertising and marketing investments and their corresponding results very closely after this AEP. The more sophisticated among them should be utilizing Kahneman’s System1/System 2 framework to help explain consumer behaviors and to better optimize their future media investments across both the emotional and rational drivers of healthcare decisions.

Increased Target Audience Focus

In Bulletin #1, we talked about the launch of Humana’s Honor Plans across 28 states in early October, focused on the unique needs of the Veterans community. We are seeing more and more examples of plans targeted to the needs of specific audiences emerging this AEP.

Aetna launched its partnership with the Fraternal Order of Police with the creation of four Aetna Medicare Advantage PPO plan options tuned to the needs of retired police officers and their spouses. It included an introductory video from FOP President @PYoes that was widely retweeted by the individual state FOP’s, as well as a plan overview video targeted specifically to FOP members who arrived at the Aetna site.

In Minnesota’s Twin Cities, 10 different senior living providers got together with a health insurer and a geriatric medical practice/care management organization to launch one of the largest special needs plans in the country, dubbed Medica Advantage Solution PartnerCare. It includes benefits targeted to people living in long-term care and senior living settings.

We expect this refined segmentation and targeting to expand even further in 2020. And while we haven’t yet seen a plan targeted to the Senior RV community, their Forums are an especially rich source of data around the unique needs of this segment. Many in that community see Medicare and supplemental better than Advantage given their nomadic lifestyle:

- “Since we are currently using Humana Wal Mart prescription plan we have no trouble getting prescriptions filled at Wal Marts while on the road.”-wagonmaster 2

- “We use a supplemental plan and see Doctors anywhere in the country with no problems. NOt tied to one area.”-momdoc

- “Our Humana Walmart plan premiums would jump from $25.60 to ~$53.00. Some drugs cheaper and some more expensive. I found two plans, one for me and one for DW that based on our drugs will save over $1500/yr. I thought it was pretty easy to plug in the drugs and see what plans where the best for us. My premims will be $13.80 with $0 cost for drugs and hers under $25/mo. It pays to shop around”-audidudi

Come to think of it, with 9 million households in the US owning an RV , and 1 million living in RV’s full-time, maybe we will see an RVIA Medicare Advantage Plan next year!

Social Determinants of Health Expansion

We continue to see expanded SDOH offerings added to plans as research has shown that these SDOH factors influence a person’s health more than the medical care he/she receives. These will continue to be a focus area moving forward as carriers look to drive value-based care solutions.

Aetna received significant engagement when it announced its partnership with Miami-based Papa Inc., that links college students to older adults who need assistance with transportation, house chores, technology lessons, companionship, and other senior services.

- “Health plans are taking note: #loneliness and #isolation are critical social determinants of health #SDOH.” – @UnLonelyProject

- “It’s time we call it what it is: a loneliness epidemic.”– @alexisohanian

In addition to the program with Papa, Aetna is also rolling out a “Social Isolation Index” to determine a senior Medicare Advantage “member’s risk of social isolation” by analyzing health claims data and other information—a great example of leveraging claims data, analytics and customer insight to drive proactive outreach.

We expect to see even more product innovation and use of analytics and insight heading into next year as insurers increasingly focus on value-based care.