2021 GROUP BENEFITS OUTLOOK SERIES

Personalizing the Benefits Experience Via Employee Segmentation

This article is part of our Benefits Outlook Series where we provide our outlook on the group benefits market while highlighting opportunities to drive go-to-market success.

With five generations now in the workplace, brokers and carriers must learn how to talk differently to employees. COVID-19 has only accelerated the need…

COVID Altering Employee Engagement Overnight

As employees are pushed into a remote and virtual working environment, so is the need for support for any and all personal and financial purposes. Traditionally, employee engagement in the benefits enrollment process was often based on on-premise open enrollment forums. Normally that was many employees packed in one room to be repeated similar benefits information as the previous year. But now, carriers and brokers must communicate one-to-one or one-to-many to employees via remote video sessions, digital tools, and the web.

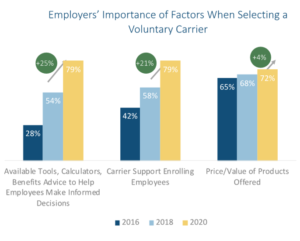

With this change, what do employers and employees need from carriers? In just one year, the importance that carriers provide digital tools, calculators, and benefits advice increased by 25%, and similarly the need for overall carrier support in enrolling employees increase by 21%.

What This Means for the Customer Experience

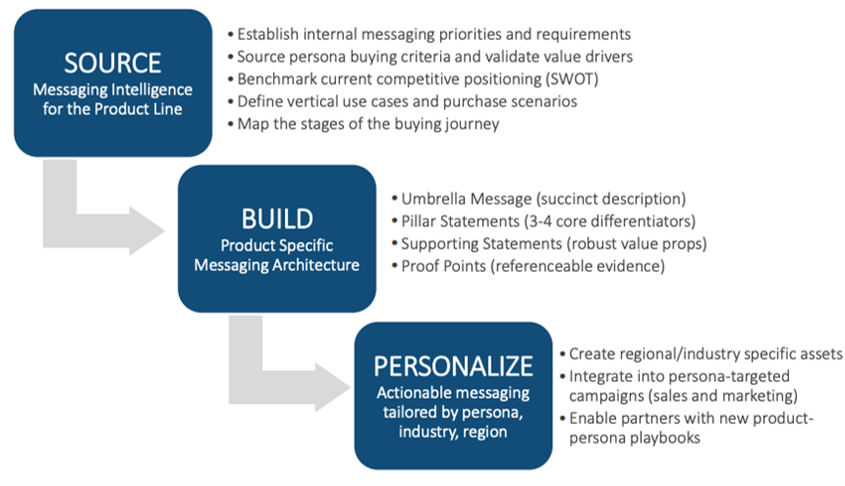

As carriers and brokers rise to answer health and financial questions in an uncertain economic environment, the need for personalization becomes critical. The increase in digital one-to-one communication presents an opportunity for carriers and brokers to deploy segment-specific, needs-specific enrollment experiences. Persona-based messaging architectures that capture and reflect the unique needs of multiple buyer sets can be deployed to provide personalized enrollment experiences which can completely transform the customer experience.

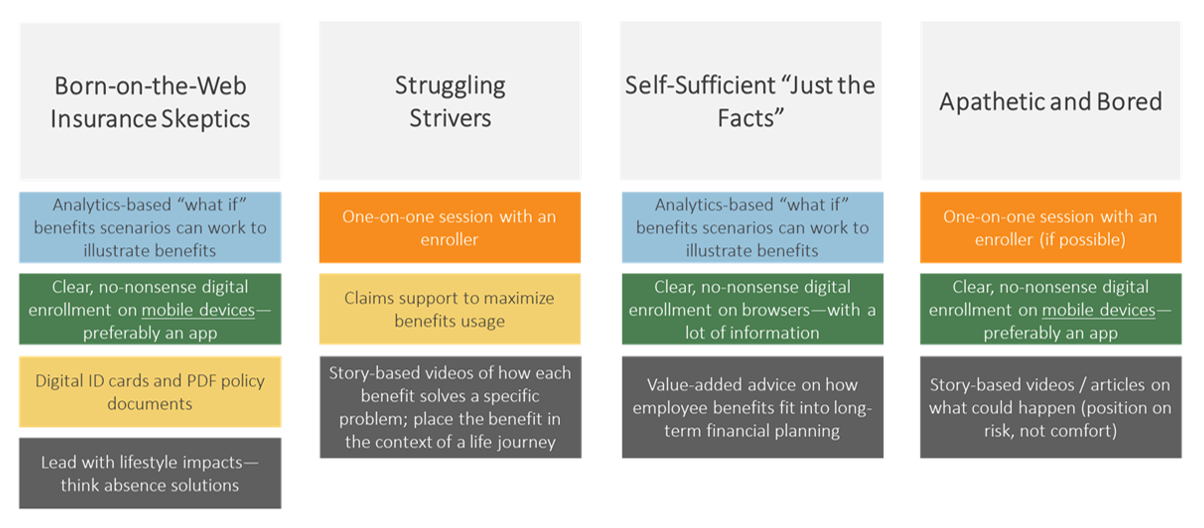

For example, we created four hypothetical employee segmentations that can be used to develop and activate more personalized and relevant positioning and enrollment experiences that will drive employee engagement and participation:

Four Core Employee Benefits Buying Personas

- Born-on-the-Web Insurance Skeptics

These tend to be younger and more digitally savvy. Having low trust for what insurance can do for them, they want to see the real value in health and voluntary benefits, without the BS. They want minimal in-person interaction and low-friction tech and tools. - Struggling Strivers

This group crosses various age brackets. They really need and want benefits but don’t quite understand how it all works. Simplicity will always trump complexity here. They typically struggle with technology and want in-person handholding. - Self-Sufficient “Just the Facts”

These tend to be older, more senior employees. This isn’t their first rodeo; they understand how benefits work. If they’ve never had supplemental benefits, they’ll let inertia win all things being equal. They will require a rich story to change their mindset. - Apathetic and Bored

This group doesn’t see the point of benefits, and their default is to minimize effort. Active enrollments are a hassle and technology—unless extremely simple—will be avoided. This group may need gamification and disruptive techniques to break through.

One key to delivering predictable revenue growth is to seamlessly connect similarly well-defined personas with a well-thought-out messaging architecture and engagement programs. Our framework explains this process in detail.

How to Develop Personalized Customer Engagement Experiences

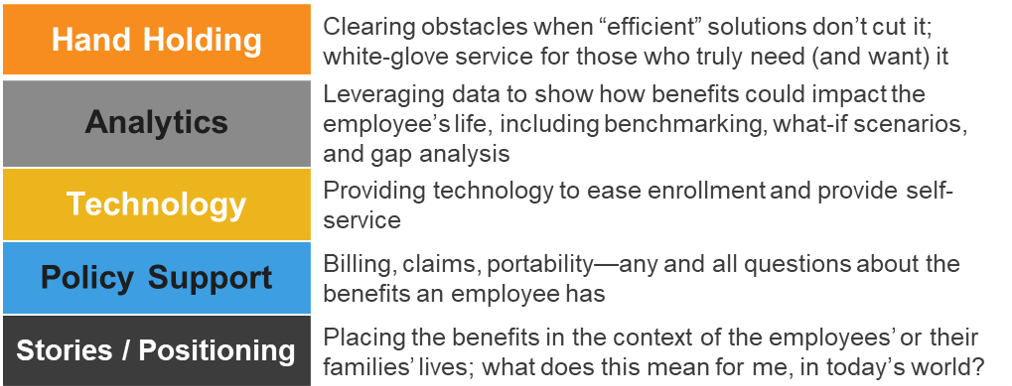

No matter which persona a buyer fits into, the fact is end-of-the-line resources should be able to convey the right message and experience based on persona. This is a task that many carriers and brokers have struggled with traditionally. We provide an example below across five areas that can be used to develop a personalized engagement experience for each of the four personas we identified above.

Five Areas of Customer Experience Refinement

Delivering a Unique Customer Experience Based on Archetype

Creating unique experiences for each persona based on these capabilities will help develop differentiated, persona-based experiences, as illustrated below:

Ultimately these personas will vary based on carriers and benefit offering ¾ but the exercise still remains. Applying the above areas of refinement in conjunction with each persona will reduce friction points, deliver trust and ease buyer decisions.

Segmenting and Mapping Buyer Journeys to Your Benefit Offerings

Delivering your most compelling message at the right time to the right buyer through the right channel is required to win each moment of truth today…and understanding and mapping your employee’s persona, needs, and digital journey are critical to making that happen.

With over 25+ years executing best-in-class sales engagement and marketing programs, we know specific buying personas must get implemented in a scalable way through marketing campaigns and the enablement of your go-to-market teams.

Here are two frameworks that can help guide you in the right direction:

- Activating a Persona-Based Messaging Architecture

Establish a messaging architecture that captures both shifting needs and multiple buyer sets. This framework provides a 10-step checklist to creating actionable personas. - Mapping Buyer Journeys for Optimal Engagement and GTM Performance

Highlighting the core elements to attract and engage benefits buyers. This framework provides step-by-step details and a case study showing how we put our customer buyer journey methodology into practice.

Read Part 1: 2021 Group Benefits: Changing Distribution and Go-to-Market Models

Next Up: From Products to Solutions!