2021 GROUP BENEFITS OUTLOOK SERIES

Shifting the Mindset from Products to Solutions

This article is part of our Benefits Outlook Series where we provide our outlook on the group benefits market while highlighting opportunities to drive go-to-market success.

Increasingly, new products, competition, and new entrants have complicated the employee benefits market. To break through the clutter, carriers and brokers are working hard to simplify the presentation of their offerings, while addressing unique customer needs. Leaders are transitioning from “products”—no longer positioning benefit’s fine print and attributes (across dental, medical, vision, life, etc.)—to broader solutions for enhanced wellbeing. And that makes sense. Employees now want benefits packages that go beyond traditional health insurance and can help improve their wellness at a holistic level—physical, mental, and financial.

To do this, executive leadership must set the stage for solution selling requiring structural changes, mindset shifts, and data-driven programmatic changes across marketing, sales, and service.

Why Brokers and Providers Alike Are Bundling Coverages (or Solution Selling)

Image via BenefitsPRO, Graphics by Chris Nicholls

This structural change most often is addressed in the form of bundled solutions. Not only can bundled solutions make the financial investment seem easier; in addition, expanded and combined offerings can set carriers apart as a “one-stop-shop” for benefits needs.

From a Financial Perspective:

Brokers are shifting from traditional medical coverages to “. . .bundl[es]. . .[combining] supplemental medical coverages, including accident, critical illness, hospital indemnity, and wellness plans” into one coordinated solution. BenefitsPRO, Nick Rockwell and Erin Marino

These bundles make the selection of plans easier for employees, but require guidance. “That guidance falls on the shoulders of brokers, who may be tempted to bundle a voluntary line just to expedite a sale.” BenefitsPRO, Nick Thornton

These bundles often focus on minimizing total financial exposure based on microtargeted risk pools, allowing integration with high-deductible plans and HSAs.

From a Market Growth Perspective:

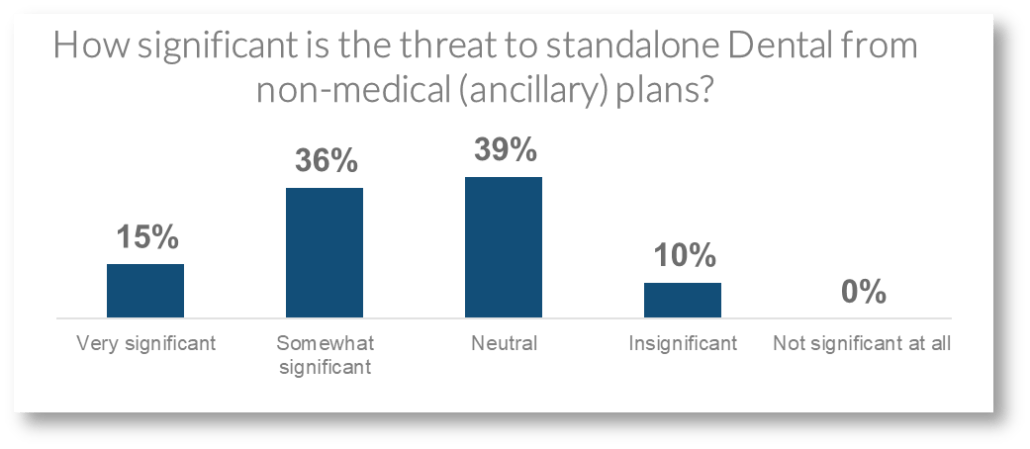

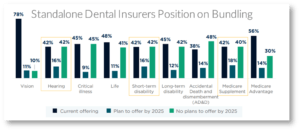

Image via West Monroe

With stand-alone, supplemental, and medical providers all introducing new products and plans, the market remains highly fragmented. Let’s look at the dental market as an example. The convergence of dental with both medical and supplemental carriers is accelerating.

West Monroe reports that 80% (vs 68% in 2018) of medical carriers are now offering dental benefits. More than half of the 20% that don’t offer dental today are also considering it.

Image via West Monroe

Supplemental carriers are also increasingly offering plans bundled with dental offerings. Even standalone dental providers (nearly half) are considering creating multi-line bundles with supplemental products.

2020 saw dramatic increases in solution bundling, particularly with medical carriers that are increasingly adding supplemental and voluntary products, including dental and vision.

The elephant in the room is the bundling of supplemental with group medical and the provision of medical discounts that can make it difficult for non-medical competitors to compete—at least on price. While these bundles pose competitive threats as medical payers increasingly move into supplemental and dental, non-medical carriers will need to increasingly compete on service, their deep focus and expertise in supplemental and dental, and on the creation of better-targeted solutions that include other non-medical components such as Stop-Loss or Life and Disability. Non-medical carriers must now differentiate on focus and service.

“Convergence of dental and health insurance is accelerating. . .while dental insurance is purchased almost exclusively on a standalone basis today, most respondents expect its market share to slip. . .” —West Monroe’s Signature Research

Transitioning from Product Marketing to Solution Selling

With benefits becoming increasingly commoditized and convoluted, meeting unique buyers with unique solutions will set businesses apart. There are 5 steps to building a customer-centric solutions strategy:

1. Defining Your Core Markets

Now is the time to listen to your brokers – understand what benefits they say consumers are needing now and how their behaviors are changing. Quickly innovate via partnerships, new products, or acquisitions and targeted solutions to adjust and pivot to the new demands and new markets. Then define those markets and dig in.

2. Conduct an Outside-in, Research-based Approach

Carriers should work with brokers and customers to create benefit solutions that align with employee needs. To do this, our advice is to reverse engineer a customer-centric approach. By shifting the perspective outward, and by using big data (data mining and digital listening) with small data (qualitative and quantitative research), you must get to know customers on a deeper level and better design solutions targeted to their needs.

3. Solutions and Messaging Development

By tuning into the needs of employees in step 2, you can bundle a group of complementary products for target personas. Consider specific employee groups; an employee with young children is likely interested in telemedicine, childcare benefits, and life insurance; single, younger employees are likely interested in student loan repayment plans, pet insurance, and financial wellness benefits. With the build of key personas and unique positioning, you can tune into needs, help eliminate friction, and enable brokers to better present offerings to administrators and employees.

4. Go-to-Market Structuring – Aligning Sales, Marketing, and Service

Transition requires new structural changes and mindset shifts. Moving forward this will require an intentional effort building an integrated approach, and connecting sales, marketing, and service for a more effective go-to-market model and a streamlined customer experience. We believe this model will continue to evolve beyond bundled solutions to actually support desired outcomes and experiences for different customer segments.

5. Activating It All to Drive Optimal Experiences

Most carriers still operate in both product and functional silos making bundling, cross-selling, and the delivery of integrated solutions more complex than they should be. Separate sales forces, actuarial teams, service organizations, and in many instances separate p and l’s, make bundling and pricing discounts, as well as servicing, a challenge.

Short-term, carriers must develop explicit and intentional bundling and cross-selling motions based on the target markets identified in Step 1. This includes the creation of a more comprehensive value proposition, updated solutions messaging and positioning as outlined in step 3, streamlined RFP processes, and explicit and competitive pricing strategies for targeted solutions.

Active enablement of the sales force and broker partners around these solutions will be essential to ensure that the message is accurately relayed, the benefits well-understood, enrollment and administration processes are streamlined, and other barriers such as compensation and technology are addressed.

Longer-term, carriers must become more digital, data-driven, and dynamic to succeed in tomorrow’s solution and outcome-based environment. This may require significant business transformation efforts to truly realign around customer needs and solutions vs. the traditional product construct that is so prevalent today.

Read Part 2: Personalizing the Benefits Experience Via Employee Segmentation

Next Up: Technology: Continuing Rise of Benefits Admin Platforms-as-a-Channel!