2021 GROUP BENEFITS OUTLOOK SERIES

Technology: Continuing Rise of Benefits Admin Platforms-as-a-Channel

This article is part of our Benefits Outlook Series where we provide our outlook on the group benefits market while highlighting opportunities to drive go-to-market success.

The pandemic has certainly been an accelerant for the industry’s digital transformation. But a massively fragmented Benefits Administration (BenAdmin), HR, Payroll, Carrier, and PEO software landscape still cannot share data effectively and drives more frustration than utility for many. The “Platform-as-a-Channel” will become increasingly important as fintech solutions and technology utilization continues to expand. William Blair expects the employee benefits technology market to grow at 7% through 2027. Carriers and brokers will have to start thinking and acting much more like technology marketers and systems integrators moving forward in the benefits admin platform-as-a-channel inevitable future.

Platform Proliferation

Employer benefits administration technology adoption has exploded. Guardian’s Workplace Study found that almost half of employers have increased their spending on benefits-related technology in the past three years, on average by more than 20%. And most are expecting increases in the next three years to address persistent benefits challenges. Challenges include expanding offerings, containing benefit costs, improving employee engagement, increasing operational efficiency, and ensuring legal compliance. Investor growth in HR technology has grown by more than 40% annually since 2012, exceeding $5B in 2019. Much of that investment is focused on core HR services, including benefits enrollment and administration.

Nearly three-quarters of employers now report that their benefits processes are more digital than paper-based. It represents one of the fastest technology growth areas internally. Nonetheless, many organizations feel the technology has yet to fully address these challenges. Nonintegrated systems, the lack of industry standards, and dependence on electronic files and data transfers continue to be major obstacles. Less than 10% of employers say they use real-time connectivity for some aspect of their benefits administration today.

The net takeaway is that technology is now a critical component of the group benefits value proposition. Brokers and carriers must continue to adapt benefits admin platform-as-a-channel strategies as part of their go-to-market.

Technology Partnerships Abound

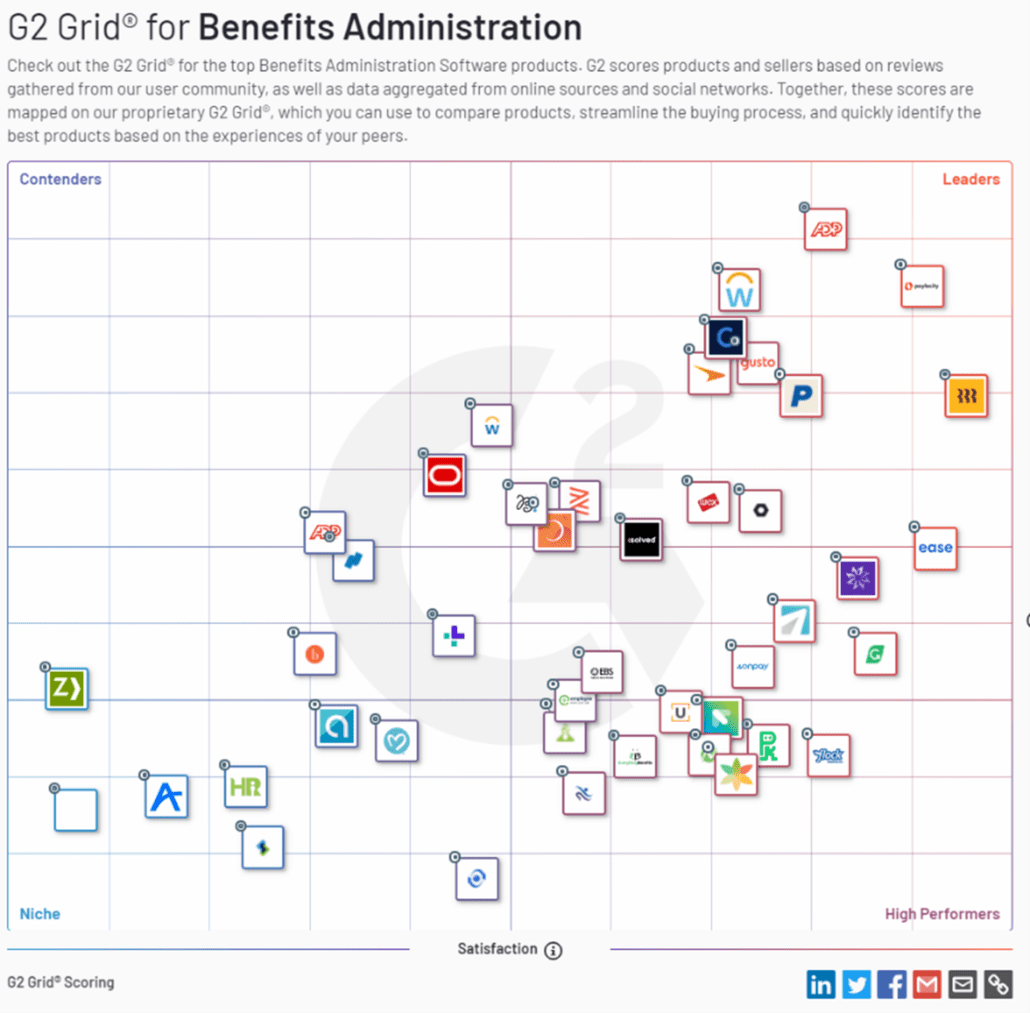

A glance at G2’s Benefits Administration Software comparison lists an astounding 182 benefits administration technology providers today!

Image via G2

In response to this increasing demand for benefits administration technology and the proliferation of providers, carriers and brokers have launched partnerships with providers, and in some cases, acquired or built benadmin or point solution tech.

It seems almost weekly we see press releases announcing a version of “Carrier X Partners With BenAdmin Platform Y to Simplify Benefits Administration.”

Technology Woes

As new partnerships are added, technical capabilities are stretched, and financial constraints are strained. Why is this?

- Lack of Data Standards

Unlike health benefits, there is a lack of data standards in the employee benefits market today:- Each BenAdmin provider has its own data exchange standard and is a unique integration

- EDI 834 is inadequate for transmitting Voluntary enrollments

- LIMRA’s Data Exchange Standards (LDex) is a potential industry solution that has just been extended to include Leave Management and Employee Assistance—but this will require many players to agree and abandon their own efforts, which seems unlikely, and they are EDI-based, while much of the industry is already beginning to migrate to API technology

- Multiple Funding Models

Different vendors have different funding models: Employer PEPM fees, Broker-Paid, and in many instances a carrier pay-to-play fee. Lack of transparency and inconsistency of funding models makes it harder to justify the increased investment. Investment made in both technical resources and one-off platform fees without a clearer picture of the return. Not to mention, a go-forward technical architecture and funding model that scales. - Multiple Customer Engagement Models

To date, most of the integrations have focused on the “order” (back-end efficiencies around enrollment, adds/drops/changes, etc. where there is significant operational inefficiency today) and not around the “storefront” (improved communication and messaging to employees, marketing collateral, plan setup objects, etc.) Over time, carriers will have to become more proficient at managing the entire customer experience across more platforms.

In the meantime, payroll companies have moved beyond file transfer to real-time APIs, and benefits carriers are following suit. The Unum and Workday partnership is a good example of this. We now see new technology players like Noyo and Vericred entering the group benefits space to provide support for a more scalable, loosely-coupled API architecture. Digital leaders like SunLife and Guardian are adopting this as a more affordable way to extend their group benefits connectivity to multiple platforms.

Expanding Role of the Platform-as-a-Channel

There is intense pressure to accelerate innovation and improve operational efficiencies for all of the benefits stakeholders. Not just for employers and employees. There is still too much manual effort and operational inefficiency in today’s fragmented benefits administration platform marketplace.

Insurance leaders must take a cue from the Tech industry and focus on creating an open-source culture. In the short term, carriers and brokers will need to continue to focus on improving data exchange and connectivity through their technology partnerships. Longer-term the industry must develop an ecosystem culture that promotes industry data standards. In addition, invest in the creation and sharing of APIs to promote cross-platform connectivity. Lastly, build more transparent pricing models that better align with value creation and exchange.

Technology is now an integral part of the benefits solution for almost every employer. Carriers and brokers must expand their enablement support for technology advice. In addition, advance the technology value proposition in the platform-as-a-channel world, similar to what is happening in tech and other industries. Microsoft, for example, divides the world into Business Decision Makers and Technical Decision Makers. They develop separate marketing content and messaging for each. And they enable their internal sellers, their business partners, and their direct-to-customer messaging accordingly. Employers are looking to their carrier and broker partners to be trusted technology advisors. Forward-thinking carriers and brokers will be adopting best practices from technology marketers to succeed in today’s technology-powered marketplace.

Read Part 3: Shifting the Mindset from Products to Solutions

Next Up: Sales Enablement!