The “Climate Change” of B2B Payments

A recent Gallup Poll showed that while a majority of Americans believe in man-made climate change, it is only a minority that believe they will personally be affected. While there are significant variations along political lines, an average assessment found that only about 45% of people had any concern that they would personally be impacted in any way by weather or climate issues. The reasoning is simple. Despite what may be believed based on a data study, people still largely make decisions based on their immediate environment and patterns. A graph or news report does not carry the weight that a blue sky or sunny day does in altering behavior. Without an actual, tangible event flooding a home or forcing an evacuation, most people are ignorant of what is at stake.

Interestingly, the same issue is true in the B2B payments world. Despite the fact that check fraud continues to be the highest type of payment danger affecting 74% of businesses in the US last year, only 10% of businesses admitted that check fraud actually concerns them in any way. Where’s the disconnect? In the exact same area that we noted for people with climate change. Without an immediate impact, most businesses are unaware of what may be at risk.

Ignorance and Inactivity a Universal Problem

This false sense of security is something we have noted across verticals and industries and is not unique to the payments space. As an example, consider the issue of data breaches. In our market research, we have noted that many SMBs are unaware their company is at risk. During recent reporting for a Fortune 500 company in the managed print services space interested in targeting the SMB sector, we noted almost 90% of SMBs do not feel they are vulnerable to security threats, even though a reported 31% of responders noted they have no controls in place to prevent hacks.

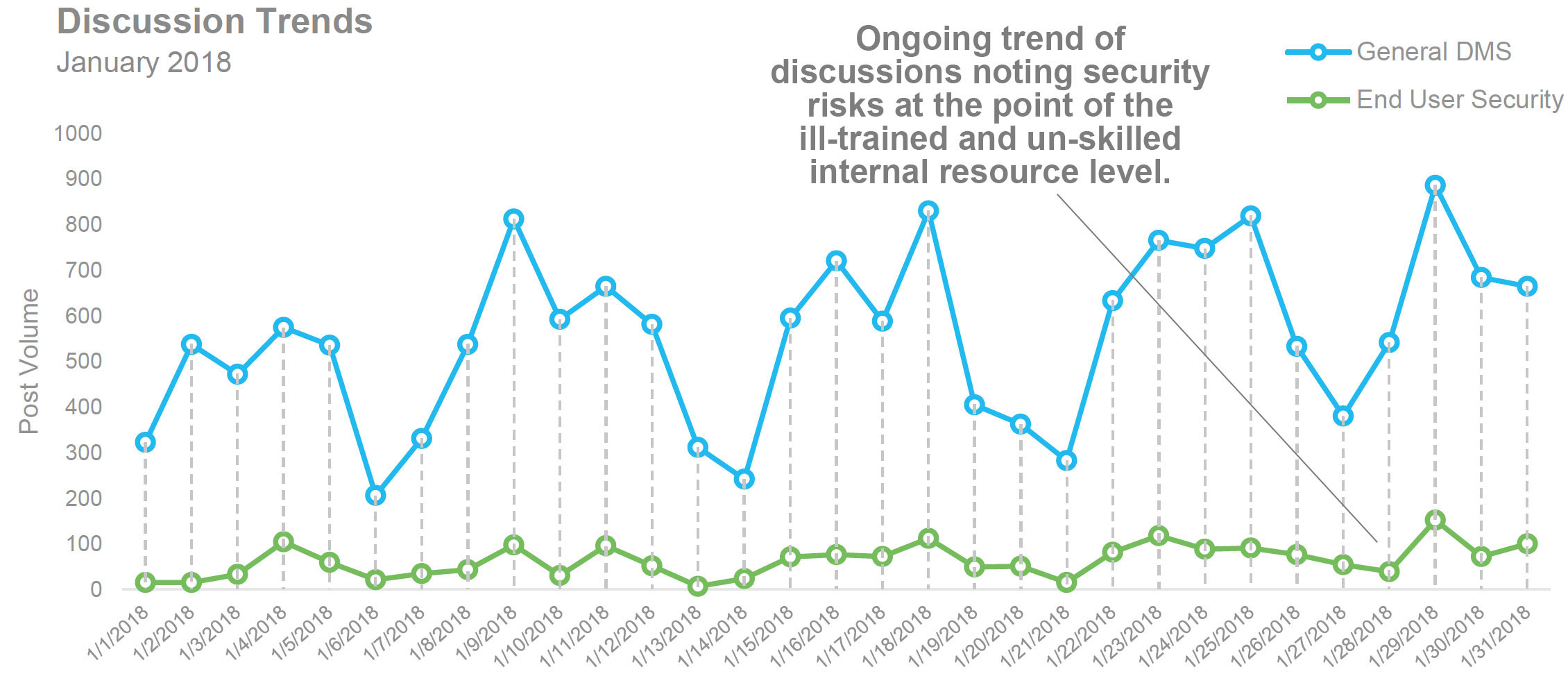

What’s interesting to note is that this ambivalence on the part of business owners actually increases their risk as hackers now know they have a “sweet spot” in the SMB space. The connection is easy to understand. A false sense of security means an absence of action. That “inactivity” is defined as companies not hiring skilled, dedicated security staff, or allocating funds to data defense which means they are easier targets for attack. Only recently have we noted the growing number of discussions by companies in the tech vertical making this connection. (See below)

The Elevated Danger in B2B Payments

In the B2B payments space, the absence of appropriate technologies handled by skilled staff trained to spot fraud is a massive factor that affects businesses. Troy Data reports that specifically with B2B check fraud, 30% of that fraud occurs internally “stem[ing] from the accounting department, more so than any other area of an organization.”

To add fuel to the fire, a study by LastPass revealed 60% of hacked SMBs will go out of business within 6 months! This stat is especially worrisome given a 2017 AEP study found half of the responding SMBs reported they in fact had experienced fraud, or attempted fraud with B2B checks; and that number is on the rise. Many companies, quite literally, cannot afford to bounce back from a fraudulent attack.

It’s a Risk vs Rewards Game…

The fast answer is go for the rewards and simply plan for the risk. Most companies should be considering turning to electronic payments to not only speed up the payments process, but to provide an additional layer of security, but buyer beware. As more emphasis is being placed on electronic payments, hackers are capitalizing on the lack of attention traditional paper checks are receiving and targeting SMBs who use or receive paper checks. Businesses need to be diligent to security protections for both traditional paper checks and electronic payments.

The Takeaway

Increasing check fraud is yet another reason companies should be considering alternative B2B payment mechanisms. Solution providers looking to win in an increasingly crowded marketplace must leverage timely market insights like the recent increases in check fraud to educate their customers on the digital B2B payments value proposition, and how their solutions help address these pain points.

Download the case study on how MarketBridge developed a best practice sales playbook for a Fortune 1000 Financial Services provider.