The Six Chapters of the Social Insights Story

In 2018, it seems that almost everything that could be said about social marketing has been said. But, when we talk to executives with “social media” in their title, whether in B2C or B2B, there is one area that still comes up as a huge untapped opportunity: deriving real-time, breakthrough insights from prospects and customers that can be immediately and impactfully reinjected back into go-to-market programs.

Almost everyone sees the potential for vastly more responsive campaigns, creative, product tweaks, and route-to-market based on the exabytes of digital data that consumers and businesses generate daily. And indeed, there are countless tools and technologies that monitor the world’s digital and social conversations for insights, and almost every Fortune 1000 company pays for at least one of them. But, when speaking with clients, they still have trouble deriving impactful go-to-market insights and strategies from these sources that can make a difference in revenue growth in this quarter. The answer isn’t fancy visualizations or more “signal”—it is human beings telling an organized, compelling story.

Social listening is literally like “boiling the ocean”—there’s almost too much data to process. Largely because of this, social listening as an industry has been hampered by a lack of organization, and a lack of narrative drive. Whereas traditional quantitative research is organized around a questionnaire or a discussion guide, social listening tends to be unstructured. Instead, analysts look for anything that pops out of the noise. This ad hoc approach can yield valuable nuggets, but too often, this general discovery yields heat rather than light when it comes to go-to-market impact. Other times, social “findings” are used as a drunk uses a lamppost—for support rather than illumination.

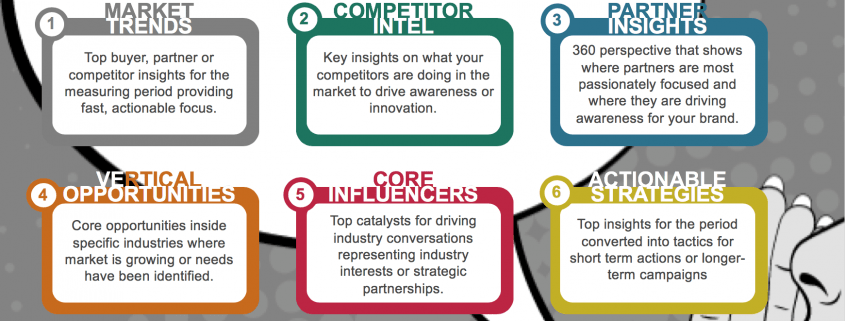

We have found that a chapter-driven approach to social media research is a much more effective and predictable way of driving real value from social listening. These six chapters go from the general to the specific, starting with broad market trends, and then moving on to competitor intelligence, partner insights, segment-level insights, and specific influencer identification and drill-down. Finally, these are all woven together into actionable strategies that can be deployed right away in go-to-market decisions across marketing, sales, and distribution.

- Market Trends: Top buyer, partner or competitor insights for the measuring period providing fast, actionable focus.

- Competitor Intel: Key insights on what your competitors are doing in the market to drive awareness or innovation.

- Partner Insights: 360 perspective that shows where partners are most passionately focused and where they are driving awareness for your brand.

- Segment / Vertical Opportunities: Core opportunities inside specific segments or industries where market is growing or needs have been identified.

- Core Influencers: Top catalysts for driving industry conversations representing industry interests or strategic partnerships.

- Actionable Strategies: Top insights for the period converted into tactics for short term actions or longer-term campaigns.

In this blog post (one of two), we cover the first three chapters in detail.

1) Market Trends

When it comes to market trends, it’s important to look for your buyer’s voice, not just industry news and reports. The core of really gathering social intelligence isn’t to deliver what everybody already knows is taking place. At the end of the day it’s asking yourself, “Well, so what?” and, “how does this affect buying decisions?”

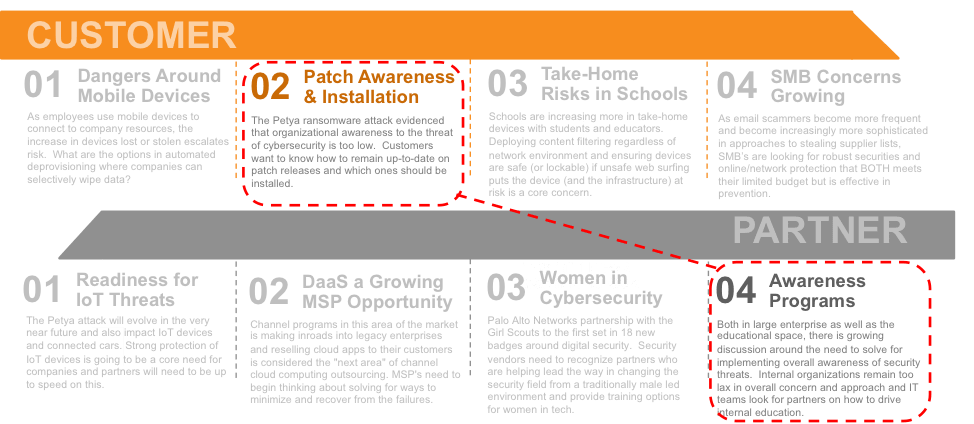

Take a ransomware attack that recently hit the news, where we asked ourselves, “Well, where we can isolate the conversations around IT managers? Where can we isolate the conversations around IT buyers? “ At the end of the day, the big intelligence gathered wasn’t simply around the fact that there was a ransomware attack, it was the notion that the people affected by it were not able to raise the awareness internally that this was a significant event. IT professionals were at a loss with how to educate their senior level management around the need for increased budget for better ultimately internal network security products.

Again, this is not “secret information,” it’s knowing where to look. Translating this information into a plan, “We need to build partner awareness programs as a first step, as opposed to pushing network security products” is where there is value.

2) Competitor Intel

Most of our clients have some type of internal competitive or market intelligence. But most of the time it’s rather “vanilla” around press releases, stocks and bonds, events and product releases. What many are missing are the early signals or indicators of competitor’s next move.

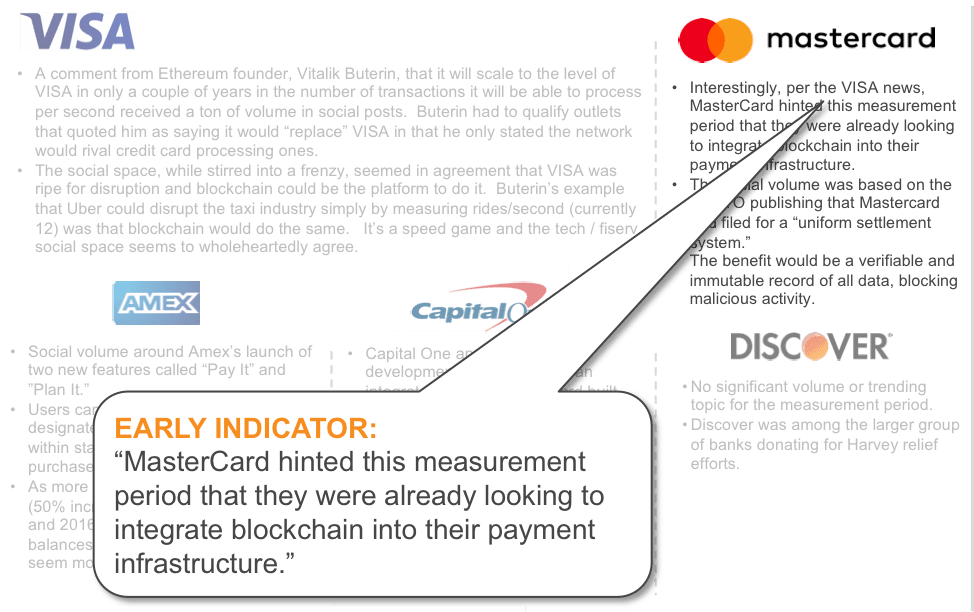

Take the conversations around bitcoin, while the discussions around Bitcoin and Ethereum and blockchain are consistently ramping up, especially in the financial services vertical, a lot of brands (at the time of our analysis) were still basically just talking about whether or not they should dip into this. Whether or not they should in any way, shape, or form change their payment structures and ultimately their payment systems. We found that MasterCard was the only one out of the entirety of the competitive set that had actually dipped their foot into it to say, “We have actually already integrated blockchain in to our payment infrastructure.”

Translating this information into a plan, “How do we competitively set ourselves up around the topic of bitcoin, or against MasterCard in the next quarter?” is where there is value.

3) Partner Insights

This element is most often not measured at all – What are your partner’s doing from a digital perspective? And what are their customer’s saying? The value here is that at the end of the day, a partner may be actually holding on to subject matter expertise that could be significantly valuable to educating other partners in the space.

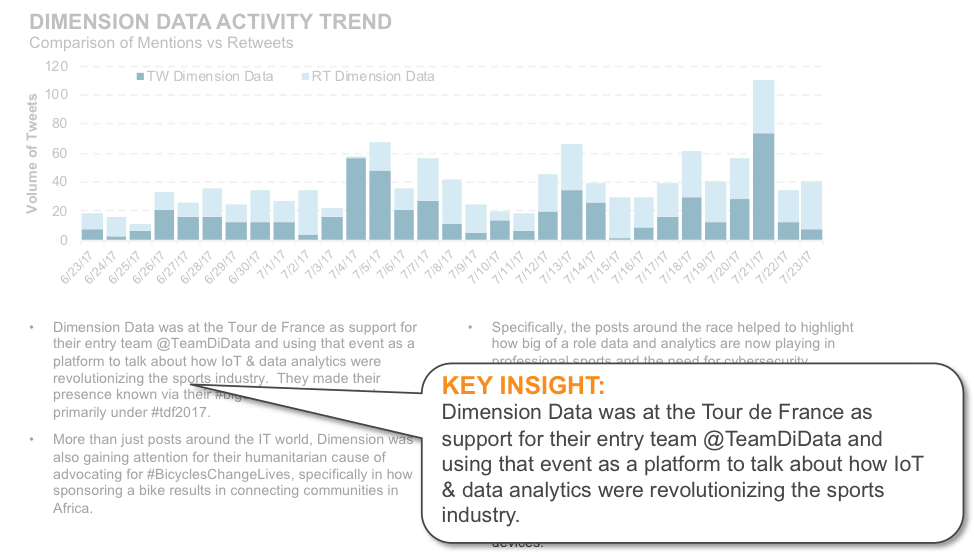

In the example below, Dimension Data was just one of a set of partner’s we analyzed. In fact, we found they spent nearly an entire month on site at the Tour De France because they had entered a team into the Tour De France. Now, that in itself might not be an interesting nugget. But, as we began drilling down into their conversations, we discovered they were actually on site with various mobile trucks holding seminars around the purpose of network security, data security, inside the professional sporting industry.

From a practical standpoint, if a vendor were to hold a monthly partner call, they may be looking for, well, what’s the content I can bring to the table every single month to educate my other partners? Just inviting this partner in to say, “Hey, talk to the rest of the partner ecosphere here about ultimately what the professional sporting industry is like.” This alone could enable other partners in their targeting efforts and spark ideas of industry specialization.

Check back in for Part 2 of this blog where we cover the remaining three elements: Segment / Vertical Opportunities, Core Influencers and Actionable Strategies.