The Last Mile Problem: 7 Steps to Closing the Insights-to-Outcomes Gap

Changing front-line behaviors with data-driven insights will be critical to realizing the benefits from your investments in analytics. It’s harder than you think!

Perhaps you are one of those companies in the CMO Survey that is planning a 218% increase in analytics spend over the next three years, or perhaps you are part of the breakaway group that already invests more than 25% of your IT budget on analytics.

Either way, make sure you are investing enough in embedding data-driven insights into sales and marketing workflow and processes and enabling the changes in front-line behaviors that are necessary to achieve desired outcomes.

This “last mile” problem is one of the key challenges that many B2B companies with complex sales and marketing processes have trouble addressing. Without focus and investment on last mile adoption, companies are severely limiting the return on their data and analytics investments. McKinsey estimates that analytic leaders spend more than 50% of their analytics budget on solving these activation issues.

Below you will find seven of the best practices for addressing last mile challenges that we have observed in working with numerous B2B clients across industries in the last 10 years. Adopting these will help you close the Insights-to-Outcomes gap that is inhibiting many companies from realizing the full potential of AI and predictive analytics.

1) Begin With The End

Many companies start their analytics journey with data, and no doubt data accuracy, quality and completeness are critical to analytics success. DNB’s 6th Annual B2B Marketing Data Report suggests that 89% of B2B companies now agree “Data Quality is Increasingly Important to the Sales and Marketing Organization.” That’s a bit like saying that gas is important for the car (or maybe electricity these days.)

Best-in-class companies start with a very clear roadmap of what business issues they must improve with analytics – and in what order. This is what we call an Applied Analytics Strategy, and it needs to be driven down from the top of the organization.

What business use cases and processes will most benefit from greater insight, and what impact will that have on business outcomes? Is it a cross-sell problem? A renewal or retention problem? A customer acquisition problem? All of the above?

With this prioritized roadmap, they then determine the type of insights they will need to change outcomes – and the data strategy that will be required to furnish those insights.

For more on Applied Analytics Strategy, read 5 CEO Principles for Developing an Applied Analytics Strategy

2) Data, Data Everywhere, Not a Drop to Drink

Building a 360 view of the customer is still a challenge for most B2B companies today. In a recent survey, 69% of enterprises said they are unable to provide a comprehensive, single customer view today.

A sound data strategy – prioritized based on the analytics roadmap – is key to driving investments in data. Many firms are deploying cloud-based data lakes as an answer to today’s disparate systems and proliferating martech stack.

Vendors are scrambling to facilitate data interoperability in a way that suits their business models (e.g. Salesforce buying Mulesoft and the recent Open Data Initiative announced by Microsoft, Adobe and SAP).

For more on ODI, read our thoughts on the MSA Data Alliance

While companies wait for the marketplace to catch up, they must be rigorous in defining a clear data ontology for their prioritized use cases, and a master data model for key domains that support their analytic efforts (for example, accounts, opportunities, leads, etc.).

These must be supported with a governance model that assigns responsibility and accountability for data quality and accuracy.

More data isn’t always better. Make sure you are leveraging the data that you already have – and focus on execution. Evaluate additional data sources carefully, and only add them in when they generate significant gain in the underlying models. And get rid of spreadsheets.

3) Mind the Gap

Data silos aren’t the only challenge. Many companies still operate in organizational silos. The gap between sales and marketing is still very wide at many B2B companies today – from a process, technology, data and reporting perspective.

Connected sales and marketing is still a thing. Create shared processes, shared data and insights and most importantly, shared measurements that align around the end-to-end customer experience.

Consider the creation of a Go-to-Market Council that meets on a regular basis to coordinate marketing and sales activities and coverage for specific customer segments. For example, with one client we host a monthly call to review prior month’s results, next month’s objectives, campaigns and offers, and sales resource availability.

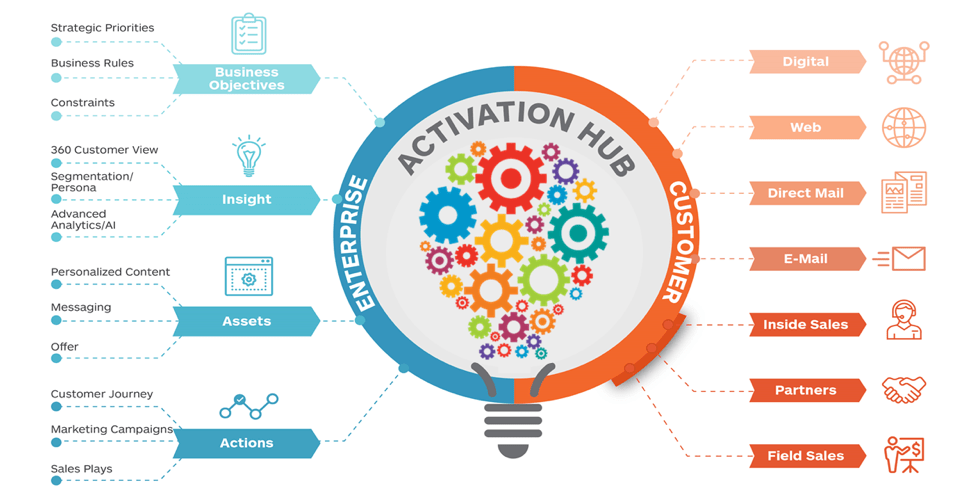

Based on that session, contacts and opportunities are assigned to defined contact strategies and dynamically allocated across marketing and sales teams and platforms based on that session, with shared objectives and KPI’s. This “Activation Hub” coordinates customer engagement across all platforms and helps ensure all teams are singing from the same hymnal (see #5 below).

4) Play To Your Audience

Getting salespeople or partners to change their behavior can be a real challenge. Most are creatures of habit. Inserting analytic insights into sales motions and expecting sales people to change their call patterns without change management and sales enablement support is a sure recipe for failure. Translating analytic output into sales context is critical to drive the adoption required to change outcomes.

Market leaders engage their sales resources early in the analytics process. This includes initial input and hypothesis generation when an analytic approach is being determined for a specific business use case; input into presentation of analytic insight within existing tools; and process re-engineering ideation as processes become more data-driven.

It also involves piloting the approach with a subset of your best reps to get feedback about both the insights and the process before it scales to the entire team.

Finally, it requires active enablement and change management from the marketing or sales enablement teams to ensure adoption. This enablement and translation may come in many forms, but key examples include:

- Converting analytic output into business context that marketers, salespeople, and partners will understand and internalize

- Aligning appropriate messaging and content with “who / when” models so that “the right touch” isn’t killed by “the wrong stuff”

- Embedding analytics into the existing sales and marketing workflow so that minimal process change is required

- Consolidating cross-channel customer engagement dispositions into a single view, to minimize switching windows and applications and to provide a holistic view of customer engagement

- Reporting positive business outcomes back to users so they believe in and trust the insights

5) Sing From the Same Hymnal

Aligning execution across all customer touchpoints is a significant challenge for almost every B2B organization today, for the reasons outlined above. It involves multiple technologies and platforms, disparate data sources, multiple resources and departments.

Creating a consistent cross-channel customer journey is as much a business strategy as a technology initiative. Gartner talks about this as the Emerging Customer Engagement Hub which will enable companies to deliver a cross-channel experience.

This is a subject for another blog, but we wanted to share with you our vision of what is included to help convert insights to outcomes and deliver on the Applied Analytics Strategy.

6) Rinse and Repeat

Test and learn. Test and learn. Test and learn. Don’t wait for the perfect analytics solution. Use an agile approach in your deployment and refine continuously.

Don’t forget your control groups. We have found many companies don’t like to have a holdout group that doesn’t get the “benefit” of data-driven insights, making it more difficult to identify real differences in performance resulting from analytics.

Maintain discipline in your measurement so that you can validate actual performance drivers, and push your analytics teams to manage their activities with a “product-centric” approach to data science that will ensure your analytics and data investments can scale to support the entire business.

For more on building a Product-Centric Data Science Organization, read here

7) Trust But Verify

Defining the likely ROI for a specific business use case for advanced analytics is one of the first steps in the process. Setting the goalposts for what you believe the outcomes should be is crucial, and should be a collaborative effort between the analytics team and the sales and marketing sponsors. What is our baseline performance today? How much of an improvement do we think we can make by applying analytics? What are the levers that will drive that improvement? If we achieve that level of performance, what are the quantifiable benefits to the business? This should all be documented at the beginning of the project.

For more on Measuring Return on Analytics, read here.

Make sure you set up a measurement framework and capability that will allow you to evaluate your performance against those targets, and more importantly help you identify where the gaps are against your initial assumptions.

For instance, we recently worked with a client to prescribe sales outreach within a defined time horizon before contract expiration. We tracked activity to make sure target outreach volumes were occurring. When the modeled conversion rate improvements weren’t achieved initially, we were able to identify that a significant volume of outreach was still occurring to customers outside of the prescribed window, thereby dampening results. This was subsequently addressed by additional enablement and management compliance.

This was a textbook example of the last mile challenge – if you cannot effectively change front-line behaviors you will not be able to close the Insights-to-Outcome gap and deliver on your investments in analytics and data.