Executing Customer Retention in Times of Disruption

We are living through an era of ‘what’s old is new’ as it relates to retention. While executives have always understood the value of keeping loyal customers, massive market transformations have raised the stakes and forced what often was a behind the scenes ‘autopilot’ type of effort to a critical front and center strategy.

In almost every vertical, there are disruptive forces at play that are reducing competitive barriers to entry, lowering customer ‘switching costs’ and dramatically lowering the steady-state lifetime value of customers. For instance, in the technology sector, the shift to subscription models has removed the stickiness factor of a CAPEX expense, and in many software and hardware markets, it is now much easier for customers to switch from one brand to the next. In consumer markets, fragmentation and new upstarts are driving similar impacts.

Executives have already been grappling with these trends over the last 5-10 years increasing investments in customer data insights, customer service/success facing roles, and overall focus on customer retention KPIs.

While these trends were already taking off at a healthy clip, the COVID-19 disruption has amplified and accelerated their trajectory. Why? Put simply, in tough times economic times, the variability of retention increases dramatically – therefore the risk increases dramatically. As companies look to weather the storm, and come out stronger on the other side, retaining the base will be the most impactful strategic effort over the next 1-2 years.

Over the years we have worked with clients across many verticals on their sales and marketing retention efforts and there is one underlying principle we have identified that acts as the centerpiece for all successful retention programs –

Retention efforts without customer data and insights fly blind, and the best data and insights are useless if not linked to prescriptive retention execution plays.

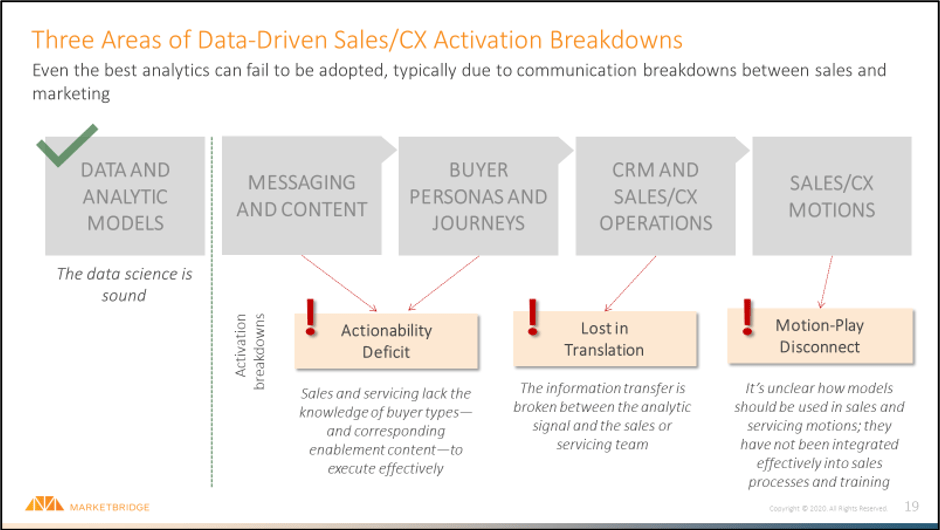

It is this critical link between data/insights and execution where the ball is all to often dropped. So many companies continue to ignore the value that customer data can provide in revealing defection risk patterns and opportunities, yet a similar number of companies have invested heavily in identifying these signals, but consistently fail to translate to value because the front-line is not equipped to execute, a dynamic highlighted in the below illustrative framework.

We’ve previously covered details on how to derive customer-driven signals through focusing on a holistic set of CX metrics and developing the right discrete customer-based retention models to effectively tier and flag risks, so want to focus on specific steps companies need to take to make sure they link insights to activation.

- Establish X-Functional Ownership of Retention – this objective is a corporate objective of critical importance, not a KPI for a single function to worry about. The first step to take is to ensure you have brought together executives across multiple functions (sales, marketing, CX, product, etc.) in a retention task force. The best strategies will come from cross-functional input.

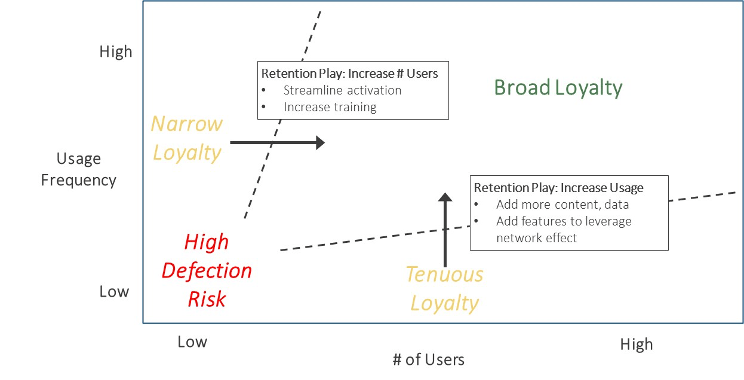

- Segment Your Customers into Actionable Retention Cohorts – this is perhaps the most common breaking point for companies, a failure to translate the signal into usable information. The issue lies in data only inferring a problem and not a solution. Consider a Red/Yellow/Green scoring system for customers, a red or yellow scoring doesn’t really tell me much about what the issues are, nor does it help guide the company towards a tangible set of actions to improve. To get over this issue, think about segmenting your customers across the retention scoring drivers into cohorts that inform differential tactics for improvement. The below visual highlights an example of this looking at customers based on usage frequency and # of users. While this can and should differ for every company, you’ll notice how a simple segmentation based on renewal drivers informs different retention strategy plays. Without this, sales & marketing will be unable to execute without every account or customer being a fire drill.

- Develop Scalable Retention Plays – Now that the right insights are linked to clear and differentiated segments, the goal is to develop specific and prescriptive actions to execute. For more SMB/Consumer-oriented companies, this will likely be more of a retention marketing focus, whereas, for more enterprise B2B oriented companies, this will be a more of a sales/CX focus. Regardless, the point is to make sure that a set of actions occur once a company or individual falls into an action cohort.

- Enable, Measure and Adjust – finally, now that data has been linked to execution, the next step is to ensure your teams are enabled to execute effectively and that ongoing monitoring and feedback loops are in place to drive agile adjustments. This age of disruption disallows autopilot GTM strategies. Constantly measure the performance of your tactical plays to improve ‘what’ you execute and constantly keep a pulse on emerging insights to inform new strategic focus areas. An always-on link between your retention execution and your retention strategy will help you drive evergreen growth.

Delivering on retention is the most critical area for GTM executives during these disruptive times. The companies that do the best job at identifying the right signals, and prescriptively linking those to activation plays will be the companies that come out of this disruptive time stronger and healthier.