Partners in Peril: 5 Strategies for Channel Adaptation

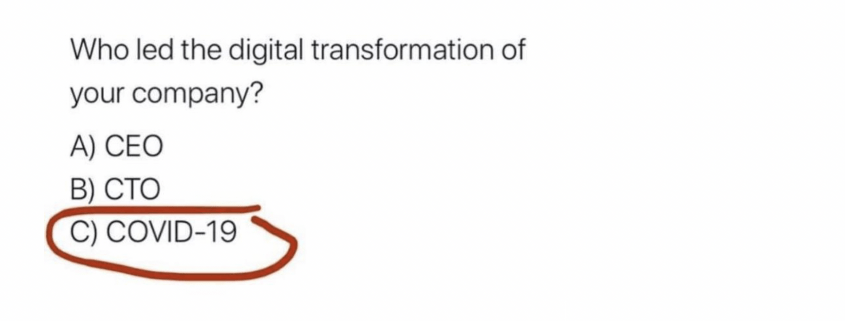

By now, everyone in the technology business has seen the tweet above. It may be equally apt to ask, What led partner transformation at your company?

- Cloud

- XaaS/Subscription Models

- COVID-19

In 2019, Forrester stated that the indirect channel was transformed more in the previous 18 months than the almost 40 years preceding – combined. And according to a recent Accenture survey of channel professionals, 76% think the channel will be unrecognizable in the next 5 years.

The channel has been transforming at a rapid pace in terms of partner composition (types/services) and business models for years. Channel leaders have been challenged with adapting to this change while maintaining focus on agility and customer-centricity without losing sight of revenue performance. Then came a global pandemic that has disrupted all aspects of life and business. The steep linear channel change curve shot upward even more.

No part of the economy has been harder hit than small businesses, and by and large, the majority of channel partners are small businesses. Forrester estimates that of the 150,000 channel partners in the US, 25% will experience unrecoverable financial distress as a result of the pandemic.

While McKinsey predicts the technology sector will suffer less badly than others, channel partners will face outsize hardship. Categories like hardware, telecommunications equipment, consulting, and integration services are disproportionally indirect channel-led and disproportionally negatively affected, as compared to infrastructure, platforms, and SaaS (which are more vendor-led).

Vendor organizations, already mandated to transform their business, must now pay special attention now to ensure the health of their channels and support their partners. The challenge is existential and strategies for success must address immediate issues without losing focus on long-term transformation. We have identified 5 key actions channel leaders must consider now to ensure the health and success of their partner ecosystems in the coming years:

Focus on Partner Experience

Customer Experience (CX) has been a popular topic for a long time. Recently my colleague Brice Chaney wrote about the need to also focus on the Partner Experience (PX). CX is determined by PX. Because of the role of the channel in the customer relationship, partner-centricity right now will not only have tremendous benefit for customers but in determining the preference and loyalty of partners moving forward

In responding to the pandemic and supporting the channel, vendors must work to understand partner needs. SAP is doing this through an ongoing pulse survey to allow partners to provide feedback and input on the kind of support they need. Vendors should also be leveraging their channel teams to facilitate ongoing communication and engagement with partners to ensure an accurate perspective on the state of their channel. Vendors can leverage these insights to craft a more partner-focused response and ensure support meets the needs of the channel.

Support the Future Channel

Microsoft, Dell, IBM, HP, HPE, and many other large vendors are throwing significant financial weight to support their channels in terms of financial relief, incentives, and financing – which is absolutely necessary. Unfortunately, these programs will likely benefit the largest (transacting) partners (based on sales volume). However, vendors need to ask themselves, Are these the partners, the partners of the future?

The focus must also be paid to emerging partner segments in terms of business model transformation goals and strategic priorities. Vendors generally know the direction of their channel and should also allocate resources to their priority future partners. In many cases, the needed support for emerging partners is often lower financial burden elements such as support, training, and access to licenses and trials. Enabling future partners will have an outsize impact now in terms of loyalty and secure long-term channel advantage.

Prioritize the Ecosystem

Every company is a technology company. As vendors have been adapting offerings to be cloud and platform-based, entirely new partner networks have been created to service the opportunity. A successful future channel will be specialized around the functions it performs in relation to the customer experience and be part of an ecosystem of complementary partners.

While still vitally important, transacting partners are being complemented more and more by non-transacting partners who influence purchases and manage ongoing relationships. Supporting the partner of the future, no doubt, is intrinsically connected to this broader ecosystem of non-transacting partners. Ensuring support now for the entire ecosystem will help solidify the network for challenges both short and long-term.

Pause Programs and Innovate

COVID-19 induced economic slowdown will certainly continue to affect revenues for the remainder of 2020 and in 2021. Just as airlines have paused their loyalty programs, to ensure partner support through recovery, many vendors such as Cisco and SAP have said they will be maintaining partner program qualification into 2021. This is a positive sign for partners who undoubtedly would struggle to meet the requirement.

With this pause, vendors have a unique to go even further and transform their programs. As Sirius Decisions pointed out in 2018, tiered partner programs and corresponding benefits have struggled to adapt to changing channel dynamics. Programs are often ineffective at influencing the desired behavior and/worse, damaging to the partner experience.

A concept MarketBridge has been advocating for some time within channel organizations has been to expand program usefulness to the broader ecosystem of partner types, business models, sizes, and commitment levels. Vendors need channel programs to work more effectively with the broader set of partners who will be pivotal to future growth. Borrowed time achieved from pausing programs can and should be leveraged to rethink channel programs all-up.

Recruit, recruit, recruit. Enable, enable, enable.

With change and disruption comes opportunity. Economic turmoil will lead to recovery and that recovery will be strong in the technology sector. As partners weather the economic uncertainty, many will be looking to expand their offerings and build new vendor relationships. Other partners will invest more heavily in time to train and certify employees.

Partner organizations should focus resources on partner recruitment and onboarding of priority partner segments now to ensure coverage and capability in meeting demand through recovery. As vital as partners are in ensuring a positive customer experience, training and enablement are vital to ensure a positive partner experience. Many vendors, large and small, are expanding free access to training and resources that may have previously been cost-prohibitive or restricted by partner level.

COVID-19 will leave an indelible mark on people, business, and culture for some time. Transformation response to this adversity should be the mark left on channel organizations. As vendors respond and adapt, focusing on supporting and building future channels is key to enable a faster return to growth and profitability.