6 Step Approach to Reinvigorating Your Competitive Positioning – Part 1

As tech competition heats up, those that innovate and work faster, better or cheaper, may win, yet while they focus on reinventing or optimizing what they bring to market, businesses that focus on how to position their solutions might be more successful in attracting buyers.

In our latest whitepaper, we highlight seven principles of how disruptors win against competition. The first principle, “have simple offerings, messaging, and pricing,” is first for a reason. Truth be told, while your most well-known products are evolving to be a better version of themselves (such as on-prem to cloud-based solutions) your neighbor is following suit. A huge gap in this race to market lies in meeting buyer’s wants and needs in relevant, simple, yet versioned messaging. While consistent, overarching messaging is important , when a specific buyer, like IT, walks in the door, can you address their individual needs and painpoints more accurately and diligently than the competition?

Here are six steps to reinvigorating your competitive positioning at the persona level. Most importantly, our approach focuses on moving beyond “words on paper” (the typical messaging framework one-and-done approach) to create action steps and playbooks for sales and marketers as they encounter various buyers.

Step 1: Establish a Baseline, Build a Fact Base

How are you positioning yourself in the market today? Is it working? Does it differ from where you want to be positioned? Facilitate an internal workshop to gain alignment on the team’s strategic vision for the solution. Your stakeholders know the value of the product better than anyone. From developers to sales leads, they know what features were built and why, and your selling team knows what benefits seal the deal in customer conversations. Tease out what has worked before and what hasn’t. Build a fact base based on internal expertise. Remember, you will ultimately need their buy-in!

Discuss:

- Where is there a gap in our messaging?

- What buyer types/personas might we be missing that need to be better addressed?

- What do stakeholders believe are the most important benefits to highlight?

- What are the table stakes value messages we have to include, and where can we differentiate ourselves?

- What are the dos and don’ts of messaging when buyers are considering other vendors?

Step 2: Conduct Agile Market Research

Market research in any form is critical to inform a top-line understanding of key competitors, target audiences, and industry trends. Consider taking a comprehensive approach to market research to collect intelligence across all of these areas. While a comprehensive approach is ideal, understanding the different market research options and outputs may help you prioritize them based on your timeline and you budget. When it comes to primary research for example, different approaches can surface varying levels of insights. With a survey, you can reach a larger number of buyers (e.g. 150+) and gain shallow, yet statistically significant insights to help inform messaging. With 1-on-1 in-depth interviews, you’ll likely reach a much smaller pool of participants (e.g. 10) but you’ll gain deeper insights and specifics. Here are the three suggested types of market research:

- Primary Research

Primary research will help you understand your users and their dynamics – from use cases, to goals and motivations, to needs and pain points. It will surface distinct personas and their journeys from pre-purchase through post-purchase.- Online Surveying (150+ survey respondents): Conduct online survey research with a mix of closed-end and free-form response types to gain a broad understanding of customer personas, customer journeys, usage experiences, and competitor perceptions.

- In-depth Interviews (10+ interviews): Conduct in-depth interviews to probe deeper into survey results and bring to life the user personas, decision-making journey and usage experiences.

Read more about another form of primary research called ethnography, and how watching customers attempt to buy, use, upgrade, and maintain your product can increase retention rates. Click here. >

- Competitive Scan

Understand your competition’s messaging, product positioning and target audiences without copying them. This will allow you to purposely differentiate while at the same time understanding the messaging tablestakes. Imagine if 5 out of 5 of your competitors are using “speed” as their value prop and all the while, you’re thinking that benefit is your “winning ticket”? Clearly, “speed” must be an important benefit to your buyer, so you too need to highlight it, yet you should not try to differentiate on it. On the other hand, if only 1 in 5 competitors are highlighting integration in their suite of benefits, that may be where you can differentiate your messaging.In initiating a competitive scan, identify your top 5 competitors. Document the landscape including similarities, differences, and ID audiences they might be addressing. Beyond their websites, what marketing campaigns are they driving across social channels and web? And that gets to number three… - Digital Listening

Digital listening techniques can be used to track thousands of industry, buyer, and competitor conversations to surface newsworthy, real-time insights as well as past historical data. Ask yourself “Do you have the eyes and ears out there to really understand what buyers, partners and influencers are saying (daily, weekly, monthly) to craft messaging?” What’s in plain sight is sometimes overlooked. Many people underestimate the value of social data and it’s actionability, but every second 60,532 GB of internet traffic is taking place. As a strong case for digital monitoring, a leading tech client of ours in the document management space was looking to uncover potential new business opportunities. Through in-depth digital listening on their keywords, competitors, and buyers, it was discovered that law firms and legal offices were seeking to use new technologies as a means of reducing filing and document management requirements of their staff so they could instead focus on client-billable hours. Here, a new target audience was identified (law firms) and a messaging course of action could be built.

Read more about how Digital Listening can ID vertical opportunities. Click here >

Step 3: Develop the Messaging and Personas

In this phase, we aggregate insights to build the messaging framework and define the personas.

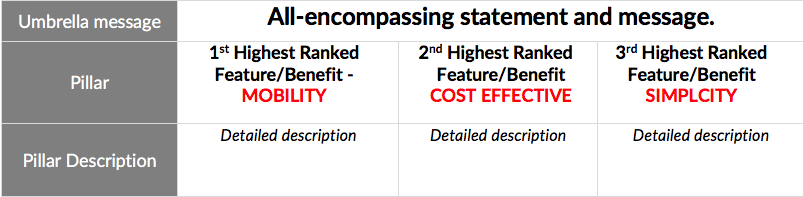

- Develop Foundational Messaging Framework

Start by developing a messaging framework structure. A typical messaging framework will consist of an overarching Umbrella Message, 3-5 core messaging themes called Pillar Messages and supporting statements accompanied by proof points/evidence. Consolidate your market research insights to understand the most important features and value props in building your messaging framework. What is the highest ranking product feature or benefit? What differentiators set you apart from competitors that were surfaced in the competitive scan? What details were repeated time and time again across one-on-one interviews? - Refine Messaging Framework by Persona

Once you have a foundational Messaging Framework, it’s time to refine your messaging based on the unique needs and pain points found for each persona. Document key persona characteristics including how different personas adopt, use, purchase and/or manage the product, and their key needs and pain points. For instance, one of your pillars may be more relevant to an IT buyer and in turn, may need additional supporting messages to address their specific needs. This may also be the priority pillar to lead with when developing IT-focused content or collateral. Technology features and benefit preferences will vary by use case and the benefits that are “must have” will be different for each persona.

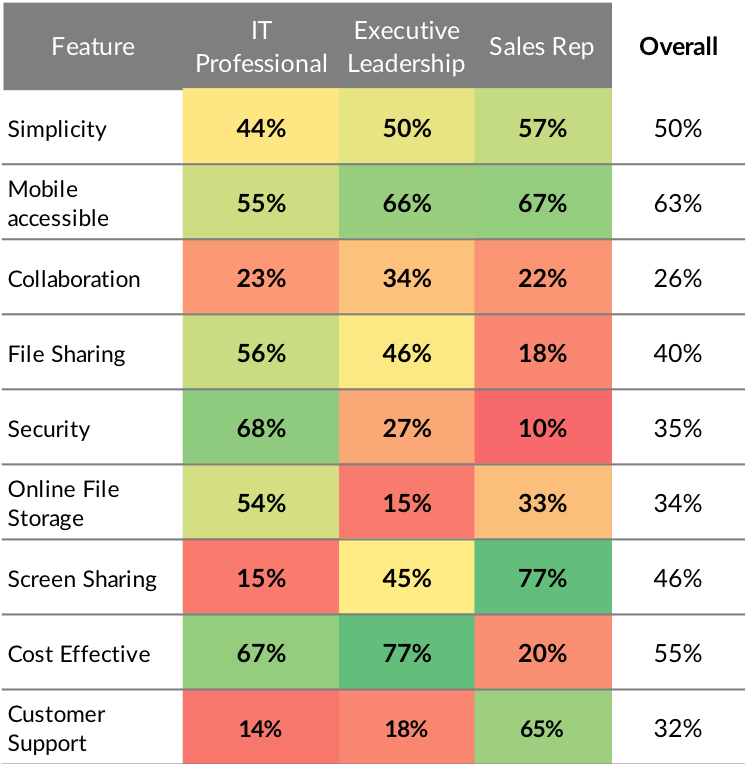

Example: Let’s say I’m a provider of a cloudbased web-conferencing solution (to the likes of WebEx or GoToMeeting). In gathering and analyzing the results from my online survey and more, I could dissect the data and rank features by buyer type to understand must-have buying considerations.

Survey Q13. Thinking about all the cloudbased web-conferencing options available, what are the most important features to you? In other words, what are your MUST-HAVES? Rank your top three.

Overarching Messaging Takeaways:

– Mobile device accessibility is a priority for all personas

Persona-Based Messaging Takeaways:

– Emphasize cost effectiveness and simplicity when speaking to executive leadership

– Highlight file storage and sharing in conjunction with security to IT professionals

Now that you have consolidated insights and understand which messaging resonates at all levels, in Part 2 of this blog will discuss making the messaging actionable. First, validate your results and reviewing with stakeholders to ensure organizational wide buy-in. And secondly, turn your architecture into useful battlecards and cheat sheets – i.e., “If I am speaking to persona A, here are exactly the words and phrases I need to say to show we convey their need.” Oftentimes a messaging framework is built simply as an encyclopedia of findings rather than a playbook for sales and marketing action. The goal should be to put all messaging into activation – in your website, marketing collateral, sales messaging, and speaker notes. Your framework should act as a guide for all go-to-market activities. Stay tuned to Part 2 of this blog as we cover:

-

Phase 4: Validation

Interview external customers to test messaging and positioning framework, identify key areas of strength and weakness.

-

Phase 5: Activating the Output

Build a playbook of conversation and market-ready copy.

-

Phase 6: Launch/Measurement

Measure ongoing trends and reaction to messaging, quantify results (sales talk time, lift, average deals size) and continuously optimize in-market.