Change and Uncertainty: 4 Priorities for Consumer Banking

4 Strategies for Growth Through Economic Uncertainty

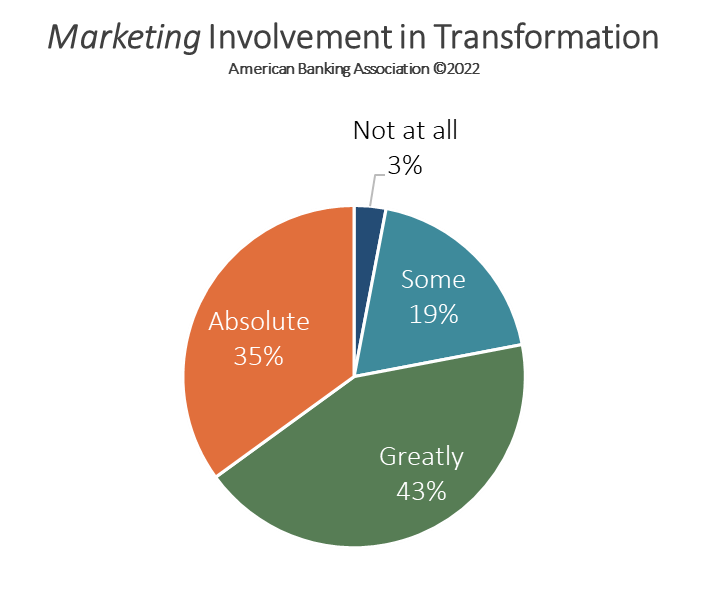

Change often starts slow, but at some point, through transition, the past seems almost unimaginable. Modern banking and financial services marketers have a lot of experience navigating a dynamic industry and marketplace. Through this change, remits have grown and expectations have increased. Marketing leaders are not only tasked with managing online and offline marketing strategies and execution but leading, full-stop, the outward-facing digital transformation of the brand.

These changes have elevated the strategic importance of marketing to the organization, shifting investment and resources in that direction. But there has also been a catch-22 facing marketers that is only now being discussed above hushed tones. While it’s true financial services are seeing strong budget growth (10.4% in 2022 according to WSJ), much of that spending is going to near-term measurable (SEM, PPC) digital tactics at the expense of branding, awareness, and consideration activities. This conflict is present in cross-industries. It’s felt stronger within financial services given the weight of transformation and the pressures of not only traditional competitive incumbents, but fintech entrants.

The impact of near-term marketing budget cuts on brand awareness and consideration is often not immediately appreciated by Marketing’s stakeholders in the enterprise. CMOs need to demonstrate in their next budgeting cycle that the illusion of savings today presents a significant risk for tomorrow.

—Gartner, The State of Marketing Budgets in 2021

Having weathered a global pandemic entering its third year, marketers had hoped 2022 would bring some normalization and renewed focus to the fundamentals of running, growing, and transforming their bands. Enter economic uncertainty. Navigating transformation and competition have become de rigueur for financial services professionals. However, the addition of economic uncertainty clouds the outlook and changes the planning calculus for the remainder of 2022 and into 2023.

Every organization has foundational priorities for digital transformation, becoming a CX-focused business, and ensuring loyalty and customer growth/satisfaction. Navigating the headwinds of transformation, digital disruption, and economic slowdown requires a new focus to maintain those priorities while adapting strategies to changing conditions.

The following strategic pillars help steer organizations through challenging times while continuing to drive value for the organizations and their customers:

Focus

Maintaining focus on key business priorities while navigating obstacles is a challenge. Most obviously when demands increase—met with an abundance of change—it becomes easy to address the immediate needs and requirements. Often causing lost focus on the larger, transformational efforts. Leaders must continue to drive focus on longer-term priorities while meeting challenges as they arise.

Successful organizations drive focus not only in cross-leadership but communicate this focus frequently and repeatedly to the entire organization. They create a shared value system that empowers employees to see their role in the change and view roadblocks as something to overcome.

Where to Focus: Best-in-class digital transformation takes a top-down unified vision for the enterprise. Ownership and holistic senior leadership acceptance will help attain higher ROI and more efficient channel economics. It requires leveraging of data and technology to optimize customer experience and processes to improve the efficiency and effectiveness of the entire organization.

Utilization

The economic downturn brings a renewed focus on cost reduction and productivity. Companies need to do more with less and ensure the maximum throughput of investments (and revenue streams). Gartner reported last year that as much as 42% of companies’ marketing tech investments are not effectively leveraged to their intended capacity or use. Underutilized technology (and data) is a common theme MarketBridge writes about. But this dramatic underutilization can be a fast way to drive better performance for marketing and sales activities, with limited (or no) additional investment.

Organizations can rely on technology vendor-partners to drive more value from their solutions. Given that >85% of enterprise martech is subscription-based, vendors are very willing to consult with customers to drive adoption and usage. Furthermore, vendors often have robust training programs to ensure employee knowledge and access to their products.

Speaking of utilization and employees, it is reported that a huge amount of employee time is unproductive. As much as 60% of employee productivity is lost through the organization–at all levels of the organization (Forbes)! While staff reduction is often a strategy that must be employed to manage through the economic tumult, it comes with the cost of rehiring and retraining as the economy recovers.

Where to Boost Utilization: Companies generally follow careful attrition plans to reduce this impact, but there is also a strong case to be made to drive better utilization of employee resources that will help not only offset potential future losses but drive greater organizational cohesion and productivity in the near term. Evaluate sources of productivity loss and take immediate action with managers to boost output both for strategic efforts, as well as immediate sales and marketing requirements.

Agility

Business agility must be a core tenant of strategic direction. If a global pandemic taught organizations anything, it was how to adapt and become more agile organizations. A lot of those learnings will come to bear through tough economic climates. And they are even more important to help organizations adapt to change inherent in driving business model transformation and more adeptly responding to competitive threats.

Agility—much like Focus—requires organizational value entrenchment and culture shift, and for organizations to define and manage processes around it. Furthermore, for business agility to be successful, it must also have clear metrics and outcomes to manage–it’s not just a nice thing to say.

Where to Drive Agility: Organizations need to define their agility goals and principles and ensure employees are both empowered and accountable to deliver on specific agile outcomes. For example, if an organization is struggling with speed to response, existing metrics both quantitative and qualitative must be benchmarked and used to determine how solutions will be judged. This will ensure not only a focus on quickly reaching a solution but also the best solution for the challenge.

Value

Value is one of those tricky things that gets tossed around a lot without consideration of the meaning. To a business, value can be the economic contribution (profit, shareholder value, macroeconomic contribution), or the value that is derived from customers, employees, or society at large. While the latter derivations are important, it can be argued that a firm focus on economic value is the most effective measure for guiding decisions both long and short-term. That is not to say the less tangle value drivers should be ignored, rather, they should be parametrized and calculated to understand the true economic value to the business. If it can be measured, it can be managed. Period.

As organizations navigate change and uncertainty, investments will be more closely watched as to their contribution to the overall productivity and output of the organization. In times of expansion and growth, investments in long-term, less defined value-generators are less-scrutinized.

Where to Enhance Value: When contraction happens, the focus will be to look at the cost side of the equation at the detriment of the return. An effective tool to ensure judiciousness with investments is to not only look at the ROI but to examine the opportunity cost and time horizon of the payoff. In some cases, longer-term investments are best to make when times are tough because the decision lens is more focused, and it forces a broader examination of the business.

Banking and financial services marketers are ready for the challenges that lie ahead. But it is ever more important to ensure a balanced strategy between long and short-term objectives that can deliver outcomes that will deliver value to the organization, customers, and shareholders through the inevitable growth periods ahead.

Access the FinTech Disruption Go-to-Market® Toolkit

Shifting demographics, consumer preferences, and expectations are massively disrupting the once predictable financial services industry. We analyzed over 100 financial services and fintech companies and surveyed 1,500 consumers across banking and payments, insurance, and investments to understand immediate strategies for financial services incumbents to secure competitive advantage.

Business Radio X and MarketBridge

Business Radio X and MarketBridge