What Financial Advisors Need to Digitally Succeed

The Power of Digital Readiness

Financial Advisors (FAs), and almost all professionals used to in-person business relationships, experienced a dramatic shift in 2020 in terms of how they interact and operate. Virtually overnight, advisors had to adapt their go-to-market practices to ensure business-as-usual and client service. As the pandemic continued to unfold, we saw the economic performance in the investment sector outshine expectations as investors looked for opportunities and sought returns from their portfolios.

Advisor and investment management firms’ ability to adapt became a clear indicator of success in the new world we’re pushed into. Research demonstrated a tangible correlation between digital readiness and financial performance across all sectors – but almost no more so than in financial advisory. A recent Broadridge survey of financial advisors found a 14% net sales increase for financial service firms that were digitally ready over firms that were considered digital laggards.

While strong investment returns account for some of the growth, economic performance does not explain the delta between the winners and losers in financial advisory. As a firm focused on digital transformation and enablement, we wanted to understand how these firms and client teams remained successful through the pandemic and what can be learned going forward to help financial advisors be ready for what’s next.

As part of our ongoing Financial Services research, we set out to answer these questions. First, to learn about financial advisors’ businesses, and then about their clients and the support they receive from their firms and/or suppliers. To do this, we surveyed 100 financial advisors in April 2021.

Financial Advisors and Business Performance

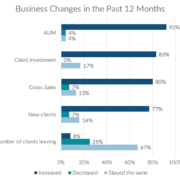

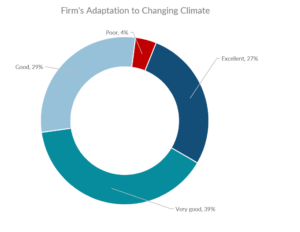

Performance insights for financial advisory practices were surprising. Overall, advisors saw strong growth across AUM, client investment, sales, and net new clients. They even reported decreased attrition of existing clients in many cases. With that said, 94% of financial advisors believe 2021 will surpass last year. More than 65% of financial advisors believe their firms have adapted to the changing environment at “Excellent or Very Good!” Their outlook reflects confidence in the forward trajectory of their business and, perhaps, the hope the worst of the pandemic is behind them.

Adapting to Client Changes

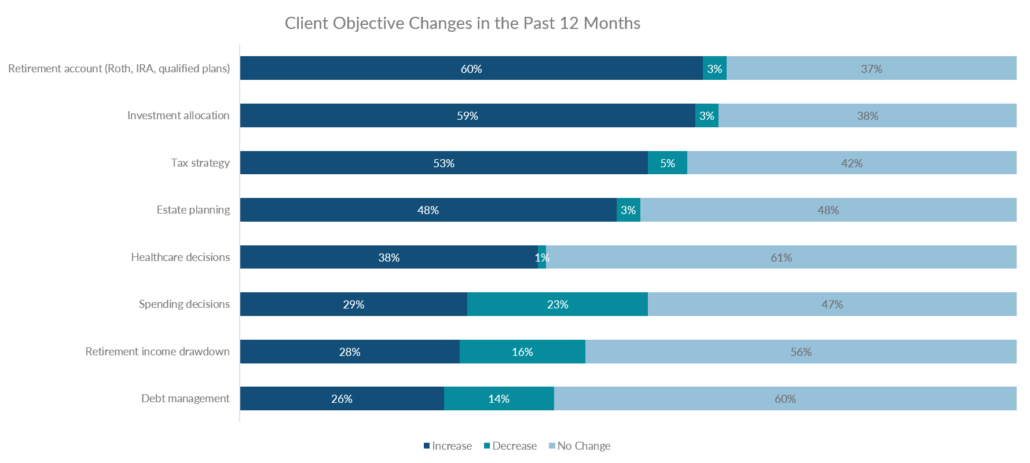

With strong market performance and client growth, we wanted to understand what advice and guidance were financial advisors’ investor clients looking for?

Client behavior reflected both market confidence, as well as shifts to maximize gains and limit risk. These forward-looking changes were much more top-of-mind with investors than drawdowns, retirement, or even healthcare considerations! (This is surprising given COVID rapidly spreading and health concerns rising across the nation.)

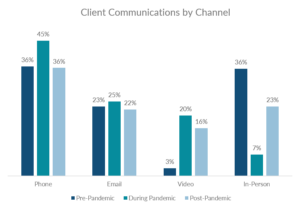

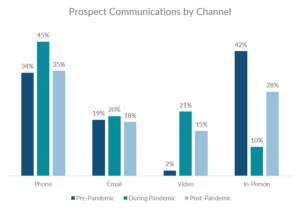

Of course, any commentary on client relations would be lacking without mention of virtual and video communications. Financial advisory had seen practically no usage in video communications prior to the pandemic. Notably, financial advisors have adapted (and likely habituated) to using video in business-as-usual practices. Video unlocked new opportunities for advisors with both prospecting and client communications – adding a more personal and interactive means of communication when in-person was not an option. Interestingly too, while there were no significant long-term marketing changes noted, video for prospecting has been indicated as an important acquisition tool going forward.

While the video is clearly here to stay (and in-person will return, but not to pre-pandemic levels) investment firms and suppliers must ensure their enablement adapts to the interactions advisors will be having – and providing new tools and content that work in this medium.

Yet Ahead…

It remains to be seen what will unfold in the second half of 2021 and into 2022. Economic indicators are strong, and it is reasonable to predict that investors will continue to maximize returns and likely be open to more risk. Enablement for advisors must continue to adapt to meet their needs as well as the needs of their clients. Support from investment firms and distribution will play a key role in this adaptation.

Digital Readiness Beyond Technology

As we noted earlier, digital readiness was a hallmark of strong pandemic performance for financial advisors. Technology played a significant role in the readiness and success of adaption. This is not surprising considering ongoing and long-term investments by firms in systems to support advisors like CRM and content management. However, at MarketBridge, we like to say technology is not a panacea.

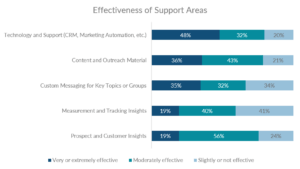

Surprisingly, while advisors had overwhelmingly positive perceptions of the level of technical support, we identified significant opportunities in enabling advisors to work better with investors. Digital readiness combined with digitally-focused support and enablement can ensure firms get the most value from their technology investments. There exist significant opportunities for investment firms and distribution to better support financial advisors through enablement:

- A Combination of Buyer Insights & Performance Measurement

Our survey results show FAs rate this area as lacking. Customer-driven insights power more personalized outreach and targeting. In addition, the same data can be measured to provide advisors feedback on what is working and so they can tweak their approaches. - Client Facing Content

Additionally, advisors are looking for fuel in their outreach and client communications. With a reliance on non-face-to-face channels well into 2021, advisors will continue to need content that can be easily shared and distributed to investors. There’s a strong analogy to sales enablement research we have done in the technology sector; OEMs have directly enabling resellers by bypassing the distribution gatekeepers to gain trust and loyalty with front-end sellers. On the distribution side, providing this type of value add can help differentiate firms and drive preference in a business often viewed as transactional.

How the Investment Industry Can Enable Financial Advisors for What Lies Ahead

Buoyed by the market, demand, and digital readiness, the investment industry adapted well to pandemic-induced changes. To be ready for what comes next, firms working with advisors must keep up with ever-changing needs and expectations. While we can’t predict the future – change is inevitable and the move to digital constant.

In building forward-looking enablement plans, consider the following three principles:

- Digital First

Thinking beyond technology and adopting digital-first will continue to the mantra for enablement. Ensuring that advisors can work with clients in any medium will open opportunities for their business and yours. - Customer-Centric

Firms that support and sell to advisors, of course, are customer-centric but extend that empathy to support advisors in their customer relationships. Deliver insights and content that help them engage with prospects and customers to help them differentiate their services and grow relationships. - Marketing-Sales Alignment

In many cases, there is a divide (and often delay) in information flows between marketing and sales. This chasm is emphasized more when there are 2 and 3-tier distribution models. Marketing and Sales working together to serve customers (and customers’ customers) is paramount to effective enablement and advisor support.

On-demand webinar – How sales and marketing teams can enable Financial Advisors to succeed

Listen in as we go in-depth on the above-mentioned survey results and discuss the processes, technology tools, and data and analytics investments needed to drive productivity and advisor enablement.