4 Strategies Group Benefits Providers Must Consider to Drive Growth

Our market intelligence team listened to 1,000’s of digital conversations this Fall around Open Enrollment to identify the top topics and themes that emerged. We combined this digital listening with client insights, competitive analysis, and our expertise to arrive at several key go-to-market themes that we believe will be critical to driving growth in the 2021 group benefits market, and beyond.

An Industry Rocked to the Core

As with many industries, COVID-19 has certainly been an accelerant for the digital transformation of the Group Benefits selection and enrollment process. With COVID, a whole new layer of complexity was added to the Fall enrollment season as the world shifted to virtual engagement—almost overnight. Even without the economic interruption, sales and marketing leaders in the group benefits market were facing headwinds.

These headwinds include:

- Increasing customer control, which means more expectations for benefits providers. Their increased knowledge creates changing expectations and needs for innovation in employer benefits

- Competitive disruption as it continues to apply pressure to incumbents. Whether it’s broker consolidation, technology-focused channels, new market entrants, or direct contracting models, carriers and brokers must be more agile in adjusting their go-to-market in response to these changing dynamics.

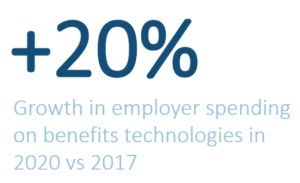

- The evolving role of technology is even a challenge. Benefits administration (BenAdmin) platforms continue to thrive since they are the key to automation and an enhanced digital customer experience.

How Do the Best Insurers Win Over Benefits Buyers in this Complex Environment?

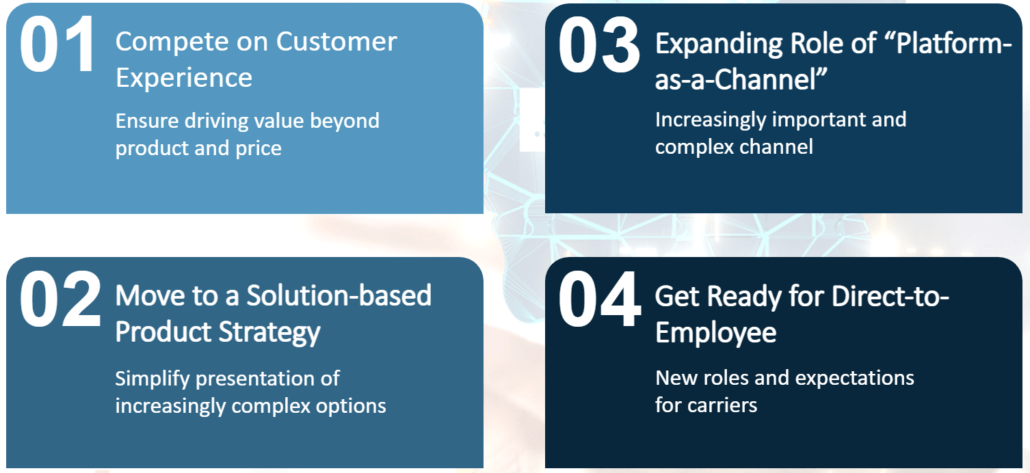

We took an outside-in approach to answer this question and found four emerging strategies we believe brokers and carriers must consider moving forward to maintain, or gain, an advantage in 2021:

(1) Compete on Customer Experience

As relationships become more digitally enabled, each companies’ best bet is to focus on driving the best customer experience for employers and employees. This can be done by fully using data and technology across the entire benefits lifecycle. This starts with simplifying and automating the customer experience, as well as building data-driven, cross-policy solutions that help all parties understand, buy, use, and access benefits.

What We Heard:

We heard a lot of frustration from employees around the use of certain supplemental and voluntary benefits because of complex submission processes. To quote one employee:

“I tried figuring out my vision insurance on my own today. There was a sarcastic chuckle just before I said screw this I’ll just pay out of pocket for those glasses.”

This problem is even more acute in the supplemental health space where the claims process can be extremely complex. Because of this, members often completely miss benefits that may be available to them.

What You Should Do:

- Empower brokers to be strategic, data-driven advisors.

Carriers that arm brokers with data-powered benefits tools will help drive informed decision-making among employers and employees. Provide brokers with these tools as well as a step-by-step guide to help employers understand how they can use and analyze their data. This, in turn, will drive penetration, loyalty, and retention among clients. - Build support tools to simplify the use of employee benefits

Employees are struggling to understand how to use the benefits they are paying for year-over-year. Offer educational information in the form of plan comparisons, benefits guides, and interactive tools to help employees use their benefits effectively and increase satisfaction. Examples include videos, agent chatbots, and personalized recommendations.

(2) Move to a Solution-based Product Strategy

While the industry reacted quickly to changing customer needs in a pandemic-stricken world, we believe there is still work to do in creating segment-specific solutions. This can be done by bundling products together to meet those segment-specific needs, and leveraging data and technology to support benefit optimization within the unique context of that solution.

What We Heard:

Interest in employee benefits significantly increased this past year. 75% of employees are more interested in their benefits than last year.¹ In response, Carriers quickly expanded and packaged their benefit offerings to meet these rapidly changing demands. They did this by offering benefits specifically targeted to changes in lifestyle (like pet insurance) and/or the unique needs of specific segments emerging as a result of COVID.

Financial well-being also came to the forefront, as 84% of customers said COVID caused stress on their personal finances.² In addition, interest in traditional Supplemental Health benefits like cancer insurance/hospital indemnity (CI/HI) increased significantly. Meanwhile, anxiety around the cost of healthcare and whether members would be covered in the case of an emergency also increased significantly.

Who capitalized? Companies like Progressive and PetsBest are building innovative partnerships to offer pet insurance repackaged this summer into a voluntary employee benefit. Fidelity too created a program to support women and caregivers, while Colonial Life launched specific new coverage for COVID-19.

What You Should Do:

- Leverage your distribution channels to understand and react to new demands with agility

Now is the time to listen to your brokers and employers. Understand what benefits they say consumers are needing now and how their behaviors are changing. Quickly innovate via partnerships, new products, or acquisitions to adjust and pivot to the new demands - …And bundle benefits to resonate with employee needs

Carriers should work with brokers to create suites of benefits that align with employee needs. An employee with young children is likely interested in telemedicine, childcare benefits, and life insurance; while single, younger employees are likely interested in student loan repayment plans, pet insurance, and financial wellness benefits. With this information, brokers can further personalize bundles to match the needs of clients.

(3) Expanding Role of “Platform-as-a-Channel”

Technology is now a critical component of the group benefits value proposition. Benefits platforms are becoming key as automation and integration fuel the rise of the platform-as-a-channel (PaaC) model. Because of this, brokers and carriers must continue to adapt to the role of PaaC as part of their go-to-market strategy.

What We Heard:

Brokers and carriers continue to respond by launching partnerships and/or acquisitions with BenAdmin technology providers and other point solution providers to meet rising employer demand and employee needs. Yet, this massively fragmented software landscape still cannot share data effectively, and arguably drives more frustration and expense than the utility.

What You Should Do:

- Develop an open-source commercial culture

Carriers and brokers must continue to invest in data exchange, connectivity, and technology partnerships across multiple platforms for the short term. In the longer term, carriers and brokers must focus on solving data and connectivity issues. The industry should push for workplace benefit standards like HIPPAA 834, the creation and sharing of APIs (Application Programming Interfaces), two-way value exchange across partnerships, and greater pricing transparency as the ecosystem matures. - Expand your enablement resources for the platform-as-a-channel

As technology becomes an increasingly vital part of the benefits solution, carriers must expand their enablement support to include the technology value proposition. Think like Microsoft. Focus on Business Decision Makers and Technical Decision Makers. Ensure your enablement supports all players in the value chain—internal resources, brokers, employers, and employees.

(4) Get Ready for Direct-to-Employee

Increasingly, employers are expecting carriers to have more direct contact with employees. With that, carriers are adding more benefits and improving the employee experience to stay competitive in a progressively direct-to-employee world.

What We Heard:

As technology enables carriers and brokers to increase their connection with employees, we see that employee support is a significant function. The need for employee-available support tools, calculators, and benefits advice to help employees make more informed decisions has risen to the top.

Of those that upped their direct-to-employee game, Aflac launched their dental and vision insurance products this year with a strong consumer brand presence—creating a significant pull through. Additionally, The Hartford updated their ‘My Tomorrow’ platform in exchange for personal information. This update included a virtual benefits fair experience and personalized benefit recommendations.

What You Should Do:

- Lead with tools, education, and support

Carriers must capitalize on employers’ desire for employees to make informed benefits decisions. Approach the conversation with prospects and current clients from an advisory standpoint. Then highlight how the available tools can help bring simplicity, transparency, and convenience to the process. - Think like a product company

Through technology, carriers have an opportunity for direct-to-employee engagement they must leverage. Brand identity and customer experience matter. Leverage the direct relationship to source consumer insights. Then weave those insights into your product and solution development, your customer experience, and your messaging, to ensure it will resonate with the end-user.

Hear these insights directly from our analysts and industry experts

Access our on-demand webinar as Bill Sheldon, VP, and Steven Lewis, VP, lead our Insurance Practice with their go-to-market expertise, walk through the reactions and sentiments of benefits buyers, and provide in-depth tactical next steps.

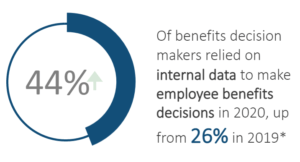

*Artemis Health and Employee Benefit News/Arizent Survey in October 2019 and 2020

(1) Forbes

(2) The Hartford’s Future of Benefits

(3) Guardian’s 9th Annual Workplace Benefits Study